Daily market summary,plan charts and data of NF – 23Jan’26

Long liquidation profile closed with rally above dVAH in last session. Buyers needed to get drive up holding VAH else overlap expected. They opened flat at LTP but could not sustain above VAH 25355 and first session gone for open auction tiring overlap into last session value area then got clean extn down then closed at dPOC. Minor weakness considered below 25340 for 25300 and major weakness marked below 25300 for 25215 bounce later 25180/25135 expected below 25215. They gone

Green tickz

7 days ago2 min read

Daily market summary,plan charts and data of NF – 22Jan’26

Neutral day with heavy volume and good swing low in last session.Above 25330 expected 25395 then squeeze above 25400 marked for 25475 and that zone marked as solid res. They opened higher and got drive up above 25330 to get 25395/25475 then failed the drive and moved down to clear IBL then remained as long liquidation profile all session.Last hour seen good demand and short squeeze pushing higher to close above dVAH. Another heavy volume day almost same volume as last session

Green tickz

Jan 221 min read

Daily market summary,plan charts and data of NF – 06Jan’26

Summary of auction from last two sessions : 05th was DD down trend day then today 06/01 was Long liquidation profile not able to accept back in upper disbn of last session and closed with dPOC down swiping PDL. Bullish hypo next > not able to stay below PDL and accepting in value could get VAH balance later test selling tail/ PDH zone then look for acceptance in upper disbn of 05/01 which translates to hypos as, failing to stay below 26250 and back above 26275 could get 26305

Green tickz

Jan 61 min read

Daily market summary,plan charts and data of NF – 29Dec’25

Long liquidation day for NF in last session with lot of good rollovers hence 26090-26120 marked as res for next session. Not able to stay above this band expected balance till 26020 then later below that marked for 25995/25965-950. NF had IB two way balance between 26030-26100 then moved down towards 25950 for close then settled at dPOC. Another long liquidation day with double print selling tail. Volume was good today. Settlement likely to take place below 26050. Immediate r

Green tickz

Dec 29, 20251 min read

Daily market summary,plan charts and data of NF – 26Dec’25

NF had FA top and NE down day auction on Thursday. Sellers staying below 26165 expected to get 26080. They opened below PDL and held lower all day to close gap from last week at 26045 then closed at dPOC. Long liquidation day. Lot of good rollovers happened on friday hence selling tail of Friday becomes good res. 26090-26120 res to start next session and 26020 support. We could look for balance inside this range. Below 26020 could get 25995/25965-25950.If sustains below 25940

Green tickz

Dec 28, 20251 min read

Daily market summary,plan charts and data of NF – 17Dec’25

Long liquidation day in last session. 25980 marked as res. They whipped this at open via drive then drive failed quick at open itself which pushed down till 25860 then ended up closing above dPOC. Another long liquidation day. 3rd day of one time frame down. Heavy poor low. Drive or gap could only clear this low else this low could act as launch pad for sm squeeze higher in next session. Such low is sign of heavy exhaustion hence get initiative move is context. If that happen

Green tickz

Dec 17, 20251 min read

Daily market summary,plan charts and data of NF – 16Dec’25

Short covering day with dPOC skew higher in last session. Buyers needed gap/drive and they didnt get that insteady opened lower in buying tail. Marked weak below 26020 for 25980-25965/25925. They gone for this entire move all day. Long liquidation day. Staying below 25980 could overlap and move down towards 25890-25880 bounce else more weakness to get 25850/25815 and further weakness if stays below 25805. Not able to stay below 25890 and back above 25935 could get 25965-25980

Green tickz

Dec 16, 20251 min read

Daily market summary,plan charts and data of NF – 03Dec’25

Another long liquidation day in last session with value in large buying tail of 26/11 trend day considered weakness. Considered weak below 26180 for 26120 bounce else 26080 expected. They moved down via open drive with volume straight below 26080 26/11 low and moved till 26050 then had tight balance and towards close got squeeze and closed above dVAH. Second day of long liquidation day below outside day. Left weak and poor low. Shorts got clean squeeze at close. 26080-26150 c

Green tickz

Dec 3, 20251 min read

Daily market summary,plan charts and data of NF – 02Dec’25

Long liquidation day with strong selling tail with outside day auction for NF in last session. Sellers needed early push down and they had the same today with minor gap and closed gap but could not sustain inside range and gone for open rej reverse down move in IB. Below 26300 expected move down till 26220 then bounce and later expected 26180-26170. They got 26220 by end of IB then remained in narrow range all day to get 26180 in last hr then bounced and closed at dPOC. Anoth

Green tickz

Dec 2, 20251 min read

Daily market summary,plan charts and data of NF – 01Dec’25

Inside day for NF in last session.If gap up means VAH considered as support. They had a gap up but could not clear ATH of last week and started accepting below inside day range and value. Not able to stay above 26495 and back below 26440 marked for 26395 bounce then 26365/26340 then 26315-26290 expected. They gone for this move fully today to get till 26301 then closed at dPOC. Long liquidation day with strong selling tail. Outside day. Trend day turned into long liquidation

Green tickz

Dec 1, 20251 min read

Daily market summary,plan charts and data of NF – 06Nov’25

Double distribution trend day down for NF in last session. Staying below 25765 expected 25650-25635/25605. They pushed above 25765 at open but could not sustain that drive and cleared low of open as well as PDL quick which pushed down to 25635..Bounced from there by mid session which failed to stay inside last session range and got 25605 for close then closed at dPOC. 5th day of one time frame down. Long liquidation auction. 25675 immediate res and 25720 strong res for next s

Green tickz

Nov 6, 20251 min read

Daily market summary,plan charts and data of NF – 30Oct’25

NF had a solid long liquidation session on Thursday. Observation was that auction was incomplete at low. Upside 26100-26120 marked as res. Downside marked for 25950/25905/25885. They had a open lower below PDL and bounced sharp via drive at open but could not sustain above res zone 26100-26120. Rejected there and failed the drive then moved to 25890 at close then closed at dPOC. Another long liquidation session. dPOC skew down at close with advantage sellers based on data and

Green tickz

Nov 2, 20252 min read

Daily market summary,plan charts and data of NF – 30Oct’25

NF had a short covering day in last session and marked 26165 as support for the decent buyers shown up. Failing to get drive up to clear PDH and moving below 26160 considered weak to get 26105 bounce else expected probe of 26060/26035/26005. They got a volume based drive down below 26160 and moved straight to 26020 by end of IB then all day had a balance holding morning tail top then closed below dPOC after making new low below IBL. Solid long liquidation session. Good sellin

Green tickz

Oct 30, 20251 min read

Daily market summary,plan charts and data of NF – 28Oct’25

Short covering day for NF in last session with advantage buyers at close. Once moves above PDH expected buyers to defend POC. they got PDH swipe at open but could not sustain and gone for a move below POC which lead to liquidation. Failing to stay above 26080 and move below 26010 marked for liquidation towards 25965 then 25890/25860/25830-25815. They got this move fully today then bounced and closed at dVAH. Long liquidation session with large tail top. Poor low. Likely to ge

Green tickz

Oct 28, 20251 min read

Daily market summary,plan charts and data of NF – 24Oct’25

NF closed as neutral extreme down day with spike down close on Thursday. 26010-26020 marked as res to start the session. Not able to sustain above expected to get PDL and below 25945 marked for a move towards 25890-25880 bounce hard.Staying below 25865 expected to get more liquidation towards 25835/25800/25765-25750. They held below 26000 at open to get 25900 then bounced and later failed to hold 25880 and moved to 25750 swipe then bounced and closed at dVAL. Long liquidation

Green tickz

Oct 26, 20251 min read

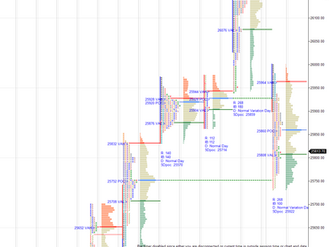

Daily market summary,plan charts and data of NF – 14Oct’25

NF opened above PDH and could not stay above 3-1-3 profile which lead to PDL swipe then stayed as trend day till mid session to clear all downside obj till 25150/25120 then bounced to VWAP and closed as long liquidation profile below dPOC. Selling tail and LL profile. Outside day. Sellers need to stay below PDL else overlap in value area and test of selling tail odds next. 25220 ref to start the day next. Holding this could test 25150-25135 bounce else liquidation towards 250

Green tickz

Oct 14, 20251 min read

Daily market summary,plan charts and data of NF - 08Oct'25

3-1-3 profile for NF in last session. At open failed to stay below VAL and gone to other end of value area i.e, VAH of last...

Green tickz

Oct 8, 20251 min read

Daily market summary,plan charts and data of NF -19Sep’25

Failed DD day for NF on Thursday. Buyers expected to stay above POC else filling today DD profile and weakness marked below PDL.Not able...

Green tickz

Sep 21, 20251 min read

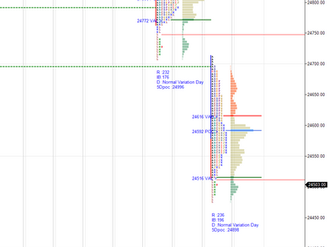

Daily market summary,plan charts and data of NF -28Aug’25

NF opened below spike low and got drive down. Staying below 24710 marked for 24600 then 24540 which they cleared in first 30mins.Bounce...

Green tickz

Aug 28, 20251 min read

Daily market summary,plan charts and data of NF -26Aug’25

Failed auction at low and neutral center day for NF on Monday. 24950 marked as support below that marked for 24910/24880 then decide...

Green tickz

Aug 27, 20251 min read