Daily market summary,plan charts and data of NF – 28Jan’26

Buyers advantage at close in last session. They had a higher open but could not sustain and gone for two way balanced day inside IB range for more of session. 3-1-3 profile closing at dPOC after leaving tails at ends and balanced profile in between. 25420 immediate support to look for drive up moving above 25490 to get 25520/25550/25580 reject else 25635-25650 odds. Not able to clear/sustain above 25490 and move below 25420 could get 25380-25365 and solid support at 25360 aga

Green tickz

2 days ago1 min read

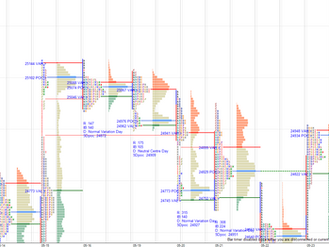

Daily market summary,plan charts and data of NF – 13Jan’26

NF had a NE up day in last session. Considered weakness below 25830 for 25765 bounce later below that 25680 bounce expected. NF got higher open above PDH failed to hold and moved below 25830 quick then met 25760 and bounced and later came down below 25760 to get 25680-25660 bounced again to close at dPOC. Another good volume day. 3-1-3 profile with tails at ends and balanced profile between tails. Sustain value area = trend else move back to other end of value area and look f

Green tickz

Jan 131 min read

Daily market summary,plan charts and data of NF – 01Jan’26

NF had a open above PDH but could not sustain. Failing to stay above PDH and below 26290 expected test of 26265-26250 and that was marked as support zone for bounce. They tagged below 26265 and bounced it. Then all day remained between 26265-26325 PDH then closed at dPOC. 3-1-3 profile with bell balance and tails at ends. Buyers of last trend day defending still. As long as they defend 26250 odds to get skew higher next. If fails to stay below 26255 in next session and moves

Green tickz

Jan 11 min read

Daily market summary,plan charts and data of NF – 22Dec’25

Gap up and short covering day with incomplete auction at high in last session.26160 marked as support and 26260 as res. They had a gap up but failed to hold and back into P value tested 26165 then bounced and rejected at 26260 then closed at dVAL. 3-1-3 profile with tails at ends and balanced value area. Sustain value area = trend else overlap in 2days value area and look for extn other side. Low volume day. 2days of value above gap now. 26160 support zone and 26260 same res

Green tickz

Dec 23, 20251 min read

Daily market summary,plan charts and data of NF – 09Dec’25

DD down day with sellers advantage at close in last session. Below 25975 marked for a move towards 25895 then below 25880 expected more. They had a gap down and moved below 25975 via drive till 25875 then bounced and closed gap till mid session. After closing gap could not accept back into yday range and moved back to dVAL then closed at dPOC. 3-1-3 profile with tails at both ends and balanced profile. Sustain value area = trend else move back to other end of value area and l

Green tickz

Dec 9, 20251 min read

Daily market summary,plan charts and data of NF – 04Dec’25

Below 26080 or above 26150 expected first session to move well today. They had a lower open from close just below 26080 but barely stayed down and got drive up to clear 26150..Above 26150 marked a move towards 26180/26210/26240-26250 which they got quick after IB..Failing to stay above 26210 and back below 26150 expected 26120/26090-26080 which they did in mid session then bounced and closed above dPOC. 3-1-3 profile with two way balanced profile with tails at both ends. Sust

Green tickz

Dec 4, 20251 min read

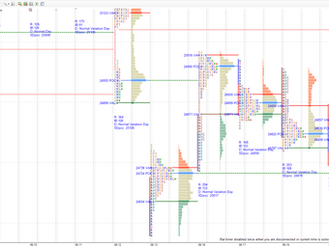

Daily market summary,plan charts and data of NF – 17Oct’25

Triple distribution trend day for NF on 16/10. Buyers job was to scale to 25680/25720 if sustains marked a move towards 25830. Open rej reverse scaled 25680 and made a move towards 25849 then pullback rejected at 25660 and closed at dPOC. 3rd day of one time frame up. 3-1-3 profile with two way balance and tails at both ends. Failing to move beyond value area could do overlap inside value area and staying beyond value area could get trending move. Buyers need to defend 25690-

Green tickz

Oct 18, 20251 min read

Daily market summary,plan charts and data of NF - 13Oct'25

Large buying tail and short covering profile for NF in last session. They opened lower in buying tail zone. 25280 no bounce means expected 25250-25235 which they got in IB then stayed inside IB range and then failing to stay below IBL moved back to dVAH for close. 3-1-3 profile with tails at both ends and balanced value area in between. Staying beyond value area = trend else overlap and test other end of value area to look for extn next. 25280 pivot for next session. Holding

Green tickz

Oct 13, 20251 min read

Daily market summary,plan charts and data of NF – 07Oct’25

Double disbn trend day up for NF in last session. Buyers if managed to defend POC then expected move higher above 25205 towards...

Green tickz

Oct 7, 20251 min read

Daily market summary,plan charts and data of NF – 30Sep’25

Failed auction at top with selling tail and neutral extreme day in last session. 24690 as good ref. Move above 24720 marked for...

Green tickz

Sep 30, 20251 min read

Daily market summary,plan charts and data of NF – 29Sep’25

Gap down and selling tail with double disbn down day for NF in last session. Not able to stay below 24665 expected fill back between...

Green tickz

Sep 29, 20251 min read

Daily market summary,plan charts and data of NF -18Aug’25

NF had a gap and drive up in IB and then could not extend beyond IB which failed the drive and moved back in morning tail..It cleared...

Green tickz

Aug 18, 20251 min read

Daily market summary,plan charts and data of NF -19Jun’25

Back to back long liquidation auction with poor low in last session for NF. they had a open lower clearing poor low then bounced and...

Green tickz

Jun 19, 20251 min read

Daily market summary,plan charts and data of NF -05Jun’25

Short covering and inside day after 3days of balance in last session. Beyond 24760 expected directional move towards 24870 which NF got...

Green tickz

Jun 5, 20251 min read

Daily market summary,plan charts and data of NF -29May’25

Normal day after a two way auction day in last session with inside day range so expected imbalance next. 24780-24810 considered as pivot...

Green tickz

May 29, 20251 min read

Daily market summary,plan charts and data of NF -26May’25

Short covering day for NF in last session with exhaustion seen at top.And they opened higher above ledge and cleared PDH to got drive...

Green tickz

May 26, 20251 min read

Daily market summary, plan, charts and data of NF – 22May’25

FA top and neutral day for NF in last session. Holding 24750 expected value overlap and below that considered weakness and then below...

Green tickz

May 22, 20251 min read

Daily market summary,plan charts and data of NF -09Apr'25

NF opened below support 22600 and stayed as lower value narrow range session all day on expiry day. 3-1-3 profile and likely to have...

Green tickz

Apr 10, 20251 min read