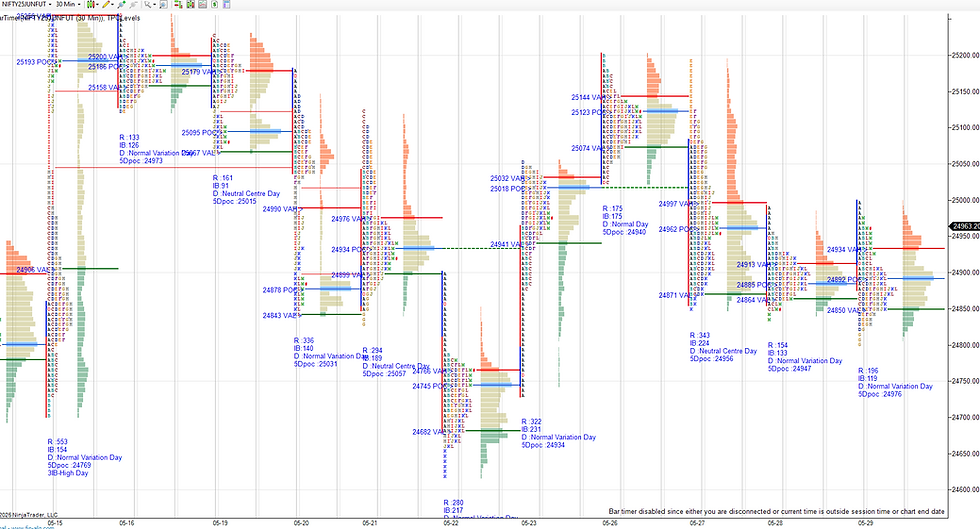

Daily market summary,plan charts and data of NF -29May’25

- Green tickz

- May 29, 2025

- 1 min read

Normal day after a two way auction day in last session with inside day range so expected imbalance next. 24780-24810 considered as pivot and below this expected PDL then a move till 24665-24650.Then not able to stay below 24700 and back to prev day range expected to get 24810.

They opened above 24810 only to swipe PDH then came down quick to move below 24810 open low which lead for a move down to PDL 24750 then later got final probe towards 24665-24650 band by mid session.Then towards close accepted in last day range to get spike back to 24810+ and closed above dVAH.

Outside day.

3-1-3 profile with tails at ends. Defend value area = trend else overlap in value area and trend other side.

As long as 24800-24850 holds looking for quick move higher towards 25020/25070 reject else 25160/25220-25240 odds..Failing to stay above 25020 and back in value area 24930 could get 24880/24850/24810 and liquidation if stays below that for 24760/24700/24650.

Chart and data :

Current month

Next month

Comments