Daily report

Daily report of summary,plan and charts

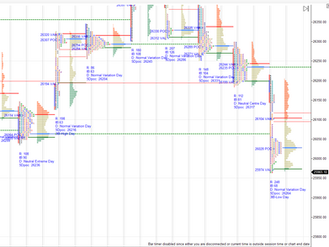

Daily market summary,plan charts and data of NF – 29Jan’26

3-1-3 profile in last session. At open itself started accepting below VAL..Below 25360 marked for a move till 25260 then bounce expected and they got this in IB then gone for balanced auction then got clean above IBH which cleared PDH and closed with dPOC higher. Double disbn up day. Outside day. dPOC skew higher. Volume was good and most of auction of second session today was short covering and no data from buyers at close. Buyers need initiative move at open to move higher

Green tickz

20 hours ago1 min read

Daily market summary,plan charts and data of NF – 28Jan’26

Buyers advantage at close in last session. They had a higher open but could not sustain and gone for two way balanced day inside IB range for more of session. 3-1-3 profile closing at dPOC after leaving tails at ends and balanced profile in between. 25420 immediate support to look for drive up moving above 25490 to get 25520/25550/25580 reject else 25635-25650 odds. Not able to clear/sustain above 25490 and move below 25420 could get 25380-25365 and solid support at 25360 aga

Green tickz

2 days ago1 min read

Daily market summary,plan charts and data of NF – 27Jan’26

NF opened at extn singles then gone down quick to clear excess low from last week. Made new low below last week low then bounced but could not clear extn handle then all day had good two way balanced auction then closed with dPOC skew higher. Buyers advantage at close. They need to defend 25360 and get drive up or gap up and once done stay higher and dont accept back in value if happens then test of POC/VAL then decide. Levels wise, defending 25360 could bounce higher to...

Green tickz

3 days ago1 min read

Daily market summary,plan charts and data of NF – 23Jan’26

Long liquidation profile closed with rally above dVAH in last session. Buyers needed to get drive up holding VAH else overlap expected. They opened flat at LTP but could not sustain above VAH 25355 and first session gone for open auction tiring overlap into last session value area then got clean extn down then closed at dPOC. Minor weakness considered below 25340 for 25300 and major weakness marked below 25300 for 25215 bounce later 25180/25135 expected below 25215. They gone

Green tickz

7 days ago2 min read

Daily market summary,plan charts and data of NF – 22Jan’26

Neutral day with heavy volume and good swing low in last session.Above 25330 expected 25395 then squeeze above 25400 marked for 25475 and that zone marked as solid res. They opened higher and got drive up above 25330 to get 25395/25475 then failed the drive and moved down to clear IBL then remained as long liquidation profile all session.Last hour seen good demand and short squeeze pushing higher to close above dVAH. Another heavy volume day almost same volume as last session

Green tickz

Jan 221 min read

Daily market summary,plan charts and data of NF – 21Jan’26

NF had a double disbn liquidation day with spike down close in last session. Expected two way fill holding below 25370 and below 25215 marked for 25120 then a move till 24975. They defended 25215 at open and bounced with drive till 25330 then failed the drive and gone below 25215 which got liquidation straight to 24965 then bounced to clear IBH..Could not sustain above IBH and gone down then settled at dPOC. Neutral day. Failed auction at top. Large buying tail with volume. 3

Green tickz

Jan 211 min read

Daily market summary,plan charts and data of NF – 20Jan’26

Balanced weekly profile resolved down in last session with neutral day. Staying below below 25635 expected weakness to continue to test PDL then liquidation marked for a move till 25420. They had a open test drive down to clear PDL at open staying below 25600 and reached 25420 by second session.Below 25450 weekly view was for spike down to get 25330/25250 which they in last hr and then closed at low. Almost a 3IB down double disbn liquidation day with spike down close. 25370-

Green tickz

Jan 201 min read

Daily market summary,plan charts and data of NF – 19Jan’26

It was neutral center day with incomplete auction at close in last session and expected to clear PDL and move down next. Staying below 25720 marked down move towards 25595 then 25535/25490. They had gap down held gap and gone down to 25530 then got tight balance, then bounced to clear IBH failed to sustain then dropped to close at dPOC. 3rd day of neutral center close. Failed auction at low. Gap down and gap held into close. Balanced weekly profile resolved down as of now. St

Green tickz

Jan 191 min read

Daily market summary,plan charts and data of NF – 16Jan’26

Inside day and neutral center day for NF on 14th.Above 25760 expected move to 25850 then above 25860 marked for 25935/25975 rejection expected. They got open rej reverse up staying above to get till 25958 then rejected and cleared IBL then closed at dPOC. Another neutral center day. dPOC skew down and auction was incomplete at close. Staying below 25800 likely to clear PDL and move down. Levels wise, below 25720 could get 25690 25660/25625/25605-25595 bounce odds else...

Green tickz

Jan 171 min read

Daily market summary,plan charts and data of NF – 14Jan’26

3-1-3 profile for NF on 13/01. Opened in last session at VAL and attempt to stay below VAL in first session failed and it moved to other end of VAH then second session dropped to clear IBL then closed at dPOC. Inside day. Neutral center day. 25760 res for next session to test PDL and goes means liquidation. Above 25760 could get 25790/25835-25850 if stays above 25860 could get 25895/25925-25935/25975 reject else 26005-26020..Above 26030 squeeze to 26060/26100/26145. If fails

Green tickz

Jan 151 min read

Daily market summary,plan charts and data of NF – 13Jan’26

NF had a NE up day in last session. Considered weakness below 25830 for 25765 bounce later below that 25680 bounce expected. NF got higher open above PDH failed to hold and moved below 25830 quick then met 25760 and bounced and later came down below 25760 to get 25680-25660 bounced again to close at dPOC. Another good volume day. 3-1-3 profile with tails at ends and balanced profile between tails. Sustain value area = trend else move back to other end of value area and look f

Green tickz

Jan 131 min read

Daily market summary,plan charts and data of NF – 12Jan’26

Staying below 25875 expected weakness to continue to get 25750 and below 25725 marked a move for 25595 they got this in first session then bounced sharp and cleared IBH then closed at high. Failed auction at low with buying tail. Neutral extreme up day. Heavy volume day marks 25725-25700 good support and extreme case 25650-25625 could act as swing support for the week. 5th day of one time frame down. Spike up close and 25869-25899 spike zone. If we open flat then 25830-25875

Green tickz

Jan 121 min read

Daily market summary,plan charts and data of NF – 09Jan’26

After a 3IB down double disbn down trend day on Thursday marked 26030 as res. Staying below this expected 25925-25915 solid bounce else expected move till 25815 then 25750/25710. They held below 26030 to get 25935 bounce failed to clear 26030 then all day stayed down to get 25725 then got bounce in last hour to close at dPOC. Another 3IB down day. Double disbn down day. 4th day of one time frame down. 25875 res for next session. Not able to clear this could go for overlap and

Green tickz

Jan 112 min read

Daily market summary,plan charts and data of NF – 08Jan’26

NF had failed auction and neutral center day in last session. Below 26185 expected 26150-26135 bounce then below 26135 marked a move towards 26040. they had a open downside bouncing from 26145 later below 26135 moved to 26040 and way below till 25965 then closed at low. High volume double disbn down trend day. Marks 26150 as good swing res going forward. Above 3IB down day. 3rd day of one time frame down. 26030 immediate res to start next session. Staying below this odds to g

Green tickz

Jan 81 min read

Daily market summary,plan charts and data of NF - 07Jan'26

Summary of the session > gap down and bounce back in value could not accept above POC and gone for neutral day with IBL swipe then closed at dPOC. Nuances from the day > Failed auction at top and neutral center day which repaired poor area of 31/12 profile. Auction bias for next session > 26300 sealed now. As long as not able to accept above this could have overlap auction and below 26185 could see liquidation and once done should not accept in value..If accepts then again ov

Green tickz

Jan 71 min read

Daily market summary,plan charts and data of NF – 06Jan’26

Summary of auction from last two sessions : 05th was DD down trend day then today 06/01 was Long liquidation profile not able to accept back in upper disbn of last session and closed with dPOC down swiping PDL. Bullish hypo next > not able to stay below PDL and accepting in value could get VAH balance later test selling tail/ PDH zone then look for acceptance in upper disbn of 05/01 which translates to hypos as, failing to stay below 26250 and back above 26275 could get 26305

Green tickz

Jan 61 min read

Daily market summary,plan charts and data of NF – 02Jan’26

NF opened above 3-1-3 balanced profile and had a open drive up. Marked bullish above 26340 for 26425 if sustains 26460/26495 expected. They tagged 26440 then gone for balance then closed with mini spike at 26480. TRend day turned into short covering day at close. Spike up close with 26450-26480 being spike zone.Stay in/above spike bullish and below spike low test VAL and buying tail bounce odds.If value in buying tail then PDL clearance odds next. Staying above 26480 for...

Green tickz

Jan 41 min read

Daily market summary,plan charts and data of NF – 01Jan’26

NF had a open above PDH but could not sustain. Failing to stay above PDH and below 26290 expected test of 26265-26250 and that was marked as support zone for bounce. They tagged below 26265 and bounced it. Then all day remained between 26265-26325 PDH then closed at dPOC. 3-1-3 profile with bell balance and tails at ends. Buyers of last trend day defending still. As long as they defend 26250 odds to get skew higher next. If fails to stay below 26255 in next session and moves

Green tickz

Jan 11 min read

Daily market summary,plan charts and data of NF – 31Dec’25

Balanced profile in last session. Acceptance above 26160 expected one way up move towards 26190/26225 no rejection means marked for 26275/26305/26330. They had a open auction accepting 26160 then got clean range extn higher via trend day to get 26325 then closed at upper quad of the day. Triple distribution trend day. 3IB day. 26250-26265 support for next session to get drive up or gap up means further push higher towards 26355-26365 acceptance could get 26395/26425 pause..La

Green tickz

Dec 31, 20251 min read

Daily market summary,plan charts and data of NF – 30Dec’25

Holding below 25980 expected PDL swipe to get 25905/25875 then bounce clearing 25945 expected to test 25980 today. They opened lower and got 25880 then bounced to test 25980 but could not accept which pushed for all day balance inside IB range then closed at dPOC. Almost a neutral day with balanced profile. Buyers need to defend VWAP of the day tmw and sustain above PDH for one way upmove..Once moved away from PDH should not accept in range if happens then overlap auction in

Green tickz

Dec 30, 20251 min read