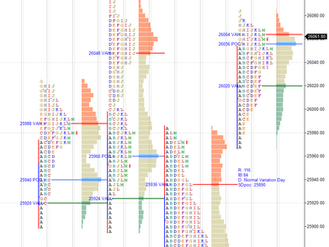

Daily market summary,plan charts and data of NF – 27Jan’26

NF opened at extn singles then gone down quick to clear excess low from last week. Made new low below last week low then bounced but could not clear extn handle then all day had good two way balanced auction then closed with dPOC skew higher. Buyers advantage at close. They need to defend 25360 and get drive up or gap up and once done stay higher and dont accept back in value if happens then test of POC/VAL then decide. Levels wise, defending 25360 could bounce higher to...

Green tickz

3 days ago1 min read

Daily market summary,plan charts and data of NF – 02Jan’26

NF opened above 3-1-3 balanced profile and had a open drive up. Marked bullish above 26340 for 26425 if sustains 26460/26495 expected. They tagged 26440 then gone for balance then closed with mini spike at 26480. TRend day turned into short covering day at close. Spike up close with 26450-26480 being spike zone.Stay in/above spike bullish and below spike low test VAL and buying tail bounce odds.If value in buying tail then PDL clearance odds next. Staying above 26480 for...

Green tickz

Jan 41 min read

Daily market summary,plan charts and data of NF – 22Dec’25

Back to back days buyers had inventory with them at close and they got large gap today and gone for tight range lower volume day holding gap all day. Gap up and buying tail. Short covering day. Auction incomplete at high. Holding 26160 odds to look for range extn higher towards 26235 pause then 26260-26280 probe. Tough to clear this zone straight and could pullback and balance. Later stays above 26280 means 26310-26320 if sustains spike to 26360-26375 odds. Not able to stay a

Green tickz

Dec 22, 20251 min read

Daily market summary,plan charts and data of NF – 19Dec’25

4th day of one time frame down with close at dPOC for NF on Thursday. Observation was that inventory wise buyers there in auction at close. Above 25980 squeeze expected to get 26010/26040 which they done quick at open till 26035 then gone for all day balance and ended at high at 26040. Short covering narrow range day stopped 4days of one time frame down. Buyers added more inventory in last session. As long as no acceptance below VAL odds to move higher. If stays below VAL or

Green tickz

Dec 20, 20251 min read

Daily market summary,plan charts and data of NF - 15Dec'25

Neutral extreme up day in last session. Below 26090 expected 26020/25985/25960 then bounce. They got drive down to 25987 then bounced all day then closed at dPOC. Short covering day. dPOC skew close higher. Buyers need gap/drive then defend POC else value overlap and test of buying tail. Not able to stay below 26090 could push higher to 26150/26180-26190 and later failing to stay higher and back below 26120 could test 26090 if sustains below that 26050/26025 odds..Comfortably

Green tickz

Dec 15, 20251 min read

Daily market summary,plan charts and data of NF – 11Dec’25

Neutral extreme down day in last session with FA top. Staying below 25945 considered weak to get a move towards 25815/25775-25765 then bounce expected. They gone for this move quick at open till 25805 then bounced and then it had wild two way auction for good time then later started accepting above IBH and ended with dPOC skew higher. Short covering profile. Same 25945 pivot for next session. As long as staying above this odds to get further move up towards 26040/26080-26090/

Green tickz

Dec 11, 20251 min read

Daily market summary,plan charts and data of NF – 05Dec’25

3-1-3 profile of previous session got a partial fill then gone for some two way wide range whips in IB period then later got short covering day which then pulled back to VWAP and closed above dPOC. Short covering auction. Profile left anomaly structure. To avoid repair buyers need to push higher early and once done dont accept back in value area. Weak low as well as poor high. 26280 support for next session. As long as this holds, odds to balance and move higher to get 26375/

Green tickz

Dec 6, 20251 min read

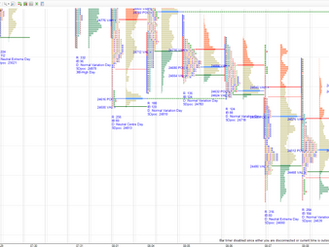

Daily market summary,plan charts and data of NF – 17Nov’25

Failed auction at low with neutral extreme up close for NF in last session.Directional move higher was bias next. Defending 25930 expected move higher next towards 26020/26050/26080. NF had open auction defending prev day range itself and moved to 26080 then closed above dPOC. Short covering day. dPOC skew and closed there. Buyers job to defend value area and move higher next. Failing to stay above PD range could go for overlap in value area and reject at VAL-PDL zone odds. L

Green tickz

Nov 17, 20251 min read

Daily market summary,plan charts and data of NF – 12Nov’25

NF had a gap up today after NE day. Above 25975 expected 26010/26040. It moved to 26020 then closed around dVAH. NF got fat tail top on short covering profile today due to some solid supply at higher quad. 26015/25965 ref for next session. Below 25965 could get 25940/25920-25905 and bounce else more weakness towards 25865/25835-25815/25785/25750. Not able to stay below 25910 could go for overlap session with a bounce back to 25950/25980/26015 and that accepts means squeeze hi

Green tickz

Nov 12, 20251 min read

Daily market summary,plan charts and data of NF – 10Nov’25

6th day of one time frame down for NF in last session and staying below 25660 was looking for lower balance test of last session. Above 25675 expected move to 25735/25765. They cleared 25675 in IB to get till 25745 then stayed in tight range and closed at dPOC. Short covering profile. Stopped 6days of one time frame down. Buyers seen from lows today and defended well all day and also seen profit booking/supply from top closing with dPOC skew down. Odds to have overlap between

Green tickz

Nov 10, 20251 min read

Daily market summary,plan charts and data of NF – 3Nov’25

NF had a long liquidation session with dPOC skew down at close with advantage sellers on Friday. Below 25885 marked for 25850/25815/25780 then bounce expected. They had a gap down and probed 25800 then bounced which could not clear days res zone 25950 and then all day gone for balance then closed at dPOC. Short covering profile after wide long liquidation range last 3 days. 3rd day of one time frame down. Clean buying tail today marks good swing support. Defending 25860 zone

Green tickz

Nov 3, 20251 min read

Daily market summary,plan charts and data of NF – 29Oct’25

Long liquidation session in last session. 26145 considered as pivot. At open via OAIR got whipped around 26145 then moved to PDH and above 26230 marked for 26265/26290 they got 26280 then closed above dPOC. Short covering day. Buying tail and some decent buying happened today. 26165 support for them tmw. Better they get drive or gap up. Failing to do so could retest 26165 zone and not able to stay below and back above 26215 could get 26240/26275. Above 26285 could get 26310/2

Green tickz

Oct 29, 20251 min read

Daily market summary,plan charts and data of NF – 27Oct’25

NF had a long liquidation in last session and opened higher above POC of last day. No rejection at 25920 means upside marked for 25980 then 26040/26080. They had a slow drive and push for IB to get 26050 then gone for tight balance then liquidation could not sustain in tail zone.Bounced and closed at dVAH. Buying tail and short covering day. Volume was good and advantage buyers at close. they may get drive/gap up and once done should defend POC if moves far away from prev day

Green tickz

Oct 27, 20251 min read

Daily market summary,plan charts and data of NF – 15Oct’25

NF had a outside day in last session. Sustaining above 25280 marked for 25330 then 25375/25410+. They had a volume based drive clearing 25280 at open to get 25330 then got IB extn to get 25410+ then gone for balance and closed at dVAH. Short covering profile. Auction looks incomplete at top. Volume based buying today and as long as buyers defend 25340 odds to have more extn higher. Levels wise 25380 support to get look for drive or gap to get 25495/25520.If sustains 25535 the

Green tickz

Oct 15, 20251 min read

Daily market summary,plan charts and data of NF – 10Oct’25

Double disbn day with skewed POC on wider disbn top for NF in last session. Buyers had to get drive or gap highe. They got clean drive...

Green tickz

Oct 11, 20251 min read

Daily market summary,plan charts and data of NF – 03Oct’25

Double disbn up trend day with good volume for NF on Wednesday with dPOC skew higher close.Not able to stay above PDH and staying below...

Green tickz

Oct 5, 20251 min read

Daily market summary,plan charts and data of NF -17Sep’25

Large buying tail and trend day for NF in last session.If sustains 25360 expected move towards 25410/25440 next.They got minor gap and...

Green tickz

Sep 17, 20251 min read

Daily market summary,plan charts and data of NF -12Sep’25

Inside day with poor low for NF in last session. If clears 25115 res marked upside move towards 25150/25180/25220. They opened with minor...

Green tickz

Sep 12, 20252 min read

Daily market summary,plan charts and data of NF -19Aug’25

3-1-3 profile with balance for NF in last session. Below 24960 expected 24925-24915 bounce then 24960 and 25060 marked as ref to look for...

Green tickz

Aug 19, 20251 min read

Daily market summary,plan charts and data of NF -11Aug’25

Large selling tail and trend day down for NF in last session. Holding below 24510 sellers expected to clear PDL to move down. Failing to...

Green tickz

Aug 11, 20251 min read