Daily market summary,plan charts and data of NF -11Apr'25

- Green tickz

- Apr 12, 2025

- 1 min read

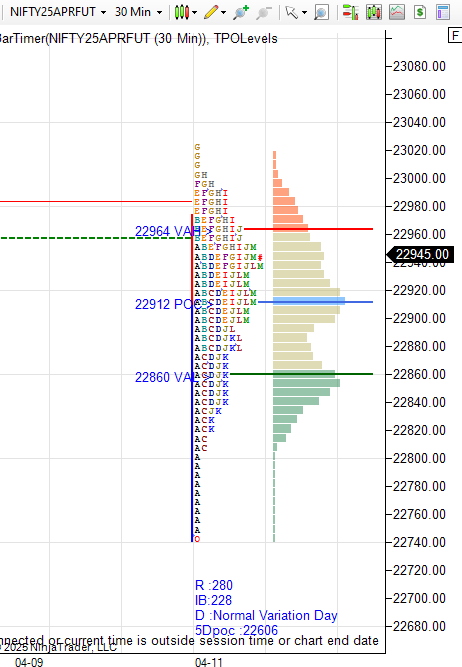

NF had a large gap up in last session. Not defending 23000-23050 expected to fill back gap.

They had a all day balance below 23000 and it was short covering profile holding large gap.

Buyers need to defend 22860 all day next session to have overlap higher and above PDH with volume any drive means bullish..Not able to stay above PDH could go for test of

Weakness and liquidation if sustains below 22860 to test tail at low and gap zone fill.

Swing wise looking for two way balance between 22800-23050-23200 max 23400 zone incase of stretch upside and staying below 22800 is weak.

Weekly and monthly :

Triple distribution week closing at higher quad of week and elongated monthly profile for Apr as of now..Immediate bias is to defend upper quad of last week and look above to start next week and not able to do so move down to test second disbn zone and accepts means fill back entire second disbn of weekly..So, defending 22800-22850 bias to get 23050/23200-23250 reject and rotate back to 23050/22850. Above 23250 acceptance is for 23400 zone which is strong res zone..Anything above that could get 23550-23600/23700/23840.

Weak below 22800 to test 22700-22650 bounce else 22500/22400 bounce and later below that could move to 22275/22200 and acceptance there could push down towards 22080/22000/21900 and below.

Charts and data :

Comments