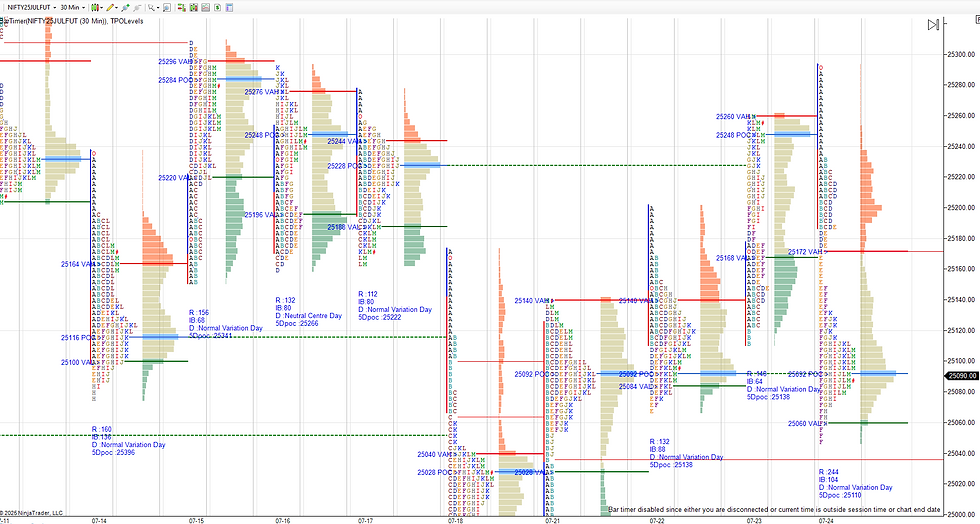

Daily market summary,plan charts and data of NF -24Jul’25

- Green tickz

- Jul 24, 2025

- 1 min read

Double distribution trend day up with poor structure skewed second disbn in last session. Failure to stay higher and accepting below POC expected to repair second disbn..They did this in first session then got acceptance in lower disbn of yday which lead to liquidation to get PDL and much lower then closed at dPOC.

Large selling tail and double disbn down day negating trend day of last session.

dPOC skew down and closed there and odds to get follow through down.

Outside day.

25090-25120 pivot for next session. Holding this looking for 25035-25025 bounce else 24975/24950 accepts means more spike down towards 24880-24870. Good move down and back in range means could test above said pivot 25090-25120 zone pullback and later sustains means 25160/25200 reject else more upside towards 25250-25260 and above .

Chart and data :

Comments