Daily market summary,plan charts and data of NF – 31Dec’25

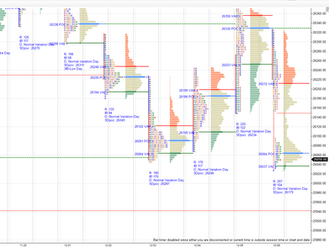

Balanced profile in last session. Acceptance above 26160 expected one way up move towards 26190/26225 no rejection means marked for 26275/26305/26330. They had a open auction accepting 26160 then got clean range extn higher via trend day to get 26325 then closed at upper quad of the day. Triple distribution trend day. 3IB day. 26250-26265 support for next session to get drive up or gap up means further push higher towards 26355-26365 acceptance could get 26395/26425 pause..La

Green tickz

Dec 31, 20251 min read

Daily market summary,plan charts and data of NF – 30Dec’25

Holding below 25980 expected PDL swipe to get 25905/25875 then bounce clearing 25945 expected to test 25980 today. They opened lower and got 25880 then bounced to test 25980 but could not accept which pushed for all day balance inside IB range then closed at dPOC. Almost a neutral day with balanced profile. Buyers need to defend VWAP of the day tmw and sustain above PDH for one way upmove..Once moved away from PDH should not accept in range if happens then overlap auction in

Green tickz

Dec 30, 20251 min read

Daily market summary,plan charts and data of NF – 29Dec’25

Long liquidation day for NF in last session with lot of good rollovers hence 26090-26120 marked as res for next session. Not able to stay above this band expected balance till 26020 then later below that marked for 25995/25965-950. NF had IB two way balance between 26030-26100 then moved down towards 25950 for close then settled at dPOC. Another long liquidation day with double print selling tail. Volume was good today. Settlement likely to take place below 26050. Immediate r

Green tickz

Dec 29, 20251 min read

Daily market summary,plan charts and data of NF – 26Dec’25

NF had FA top and NE down day auction on Thursday. Sellers staying below 26165 expected to get 26080. They opened below PDL and held lower all day to close gap from last week at 26045 then closed at dPOC. Long liquidation day. Lot of good rollovers happened on friday hence selling tail of Friday becomes good res. 26090-26120 res to start next session and 26020 support. We could look for balance inside this range. Below 26020 could get 25995/25965-25950.If sustains below 25940

Green tickz

Dec 28, 20251 min read

Daily market summary,plan charts and data of NF – 24Dec’25

Another day NF locked between 26160-26260 support and res zone. It has left failed auction at top. Neutral extreme down day. Outside day. 26210 res for next session. Sellers staying below 26165 could test 26140/26115/26090-26080. Not able to stay below 26150 and back above 26180 could test 26210 reject else 26240-26250..Above 26260 could move to 26290/26320. Chart and data :

Green tickz

Dec 25, 20251 min read

Daily market summary,plan charts and data of NF – 22Dec’25

Gap up and short covering day with incomplete auction at high in last session.26160 marked as support and 26260 as res. They had a gap up but failed to hold and back into P value tested 26165 then bounced and rejected at 26260 then closed at dVAL. 3-1-3 profile with tails at ends and balanced value area. Sustain value area = trend else overlap in 2days value area and look for extn other side. Low volume day. 2days of value above gap now. 26160 support zone and 26260 same res

Green tickz

Dec 23, 20251 min read

Daily market summary,plan charts and data of NF – 22Dec’25

Back to back days buyers had inventory with them at close and they got large gap today and gone for tight range lower volume day holding gap all day. Gap up and buying tail. Short covering day. Auction incomplete at high. Holding 26160 odds to look for range extn higher towards 26235 pause then 26260-26280 probe. Tough to clear this zone straight and could pullback and balance. Later stays above 26280 means 26310-26320 if sustains spike to 26360-26375 odds. Not able to stay a

Green tickz

Dec 22, 20251 min read

Daily market summary,plan charts and data of NF – 19Dec’25

4th day of one time frame down with close at dPOC for NF on Thursday. Observation was that inventory wise buyers there in auction at close. Above 25980 squeeze expected to get 26010/26040 which they done quick at open till 26035 then gone for all day balance and ended at high at 26040. Short covering narrow range day stopped 4days of one time frame down. Buyers added more inventory in last session. As long as no acceptance below VAL odds to move higher. If stays below VAL or

Green tickz

Dec 20, 20251 min read

Daily market summary,plan charts and data of NF – 18Dec’25

Long liquidation day with heavy poor low in last session. 25850 marked as support. They cleared that at open. Below 25850 probe marked for 25825-25815/25775 they moved till 25800 then bounced higher. 25965-25980 marked for pullback but they completely reversed morning move from this zone to get PDL then closed at dPOC. 4th day of one time frame down. Inventory wise buyers there in auction at close today. DP tail top and clean buying tail low with poor value area. So, no accep

Green tickz

Dec 18, 20251 min read

Daily market summary,plan charts and data of NF – 17Dec’25

Long liquidation day in last session. 25980 marked as res. They whipped this at open via drive then drive failed quick at open itself which pushed down till 25860 then ended up closing above dPOC. Another long liquidation day. 3rd day of one time frame down. Heavy poor low. Drive or gap could only clear this low else this low could act as launch pad for sm squeeze higher in next session. Such low is sign of heavy exhaustion hence get initiative move is context. If that happen

Green tickz

Dec 17, 20251 min read

Daily market summary,plan charts and data of NF – 16Dec’25

Short covering day with dPOC skew higher in last session. Buyers needed gap/drive and they didnt get that insteady opened lower in buying tail. Marked weak below 26020 for 25980-25965/25925. They gone for this entire move all day. Long liquidation day. Staying below 25980 could overlap and move down towards 25890-25880 bounce else more weakness to get 25850/25815 and further weakness if stays below 25805. Not able to stay below 25890 and back above 25935 could get 25965-25980

Green tickz

Dec 16, 20251 min read

Daily market summary,plan charts and data of NF - 15Dec'25

Neutral extreme up day in last session. Below 26090 expected 26020/25985/25960 then bounce. They got drive down to 25987 then bounced all day then closed at dPOC. Short covering day. dPOC skew close higher. Buyers need gap/drive then defend POC else value overlap and test of buying tail. Not able to stay below 26090 could push higher to 26150/26180-26190 and later failing to stay higher and back below 26120 could test 26090 if sustains below that 26050/26025 odds..Comfortably

Green tickz

Dec 15, 20251 min read

Daily market summary,plan charts and data of NF – 12Dec’25

NF had a gap up and gone for almost a gap close then bounced and closed at highs. Neutral extreme up day with 2 points gap. 26090 support for next session. Buyers holding this and scaling above PDH 26160 could move to 26200/26240 pullback else 26310/26375 odds. Weak below 26090 for 26020 bounce back to 26090 accepts means 26125/26160 then above scenario. Staying below 26020 could get 25985/25960 bounce else 25920/25880 odds. Weekly and monthly: Long liquidation week closed ab

Green tickz

Dec 14, 20251 min read

Daily market summary,plan charts and data of NF – 11Dec’25

Neutral extreme down day in last session with FA top. Staying below 25945 considered weak to get a move towards 25815/25775-25765 then bounce expected. They gone for this move quick at open till 25805 then bounced and then it had wild two way auction for good time then later started accepting above IBH and ended with dPOC skew higher. Short covering profile. Same 25945 pivot for next session. As long as staying above this odds to get further move up towards 26040/26080-26090/

Green tickz

Dec 11, 20251 min read

Daily market summary,plan charts and data of NF – 10Dec’25

3-1-3 profile it was for NF in last session. It held at VAL zone at open and bounced to VAH but failed to extend higher then dropped back to VAL then cleared PDL and closed at low. Outside day. Neutral extreme down day. Failed auction at top. Staying below 25945 its weak for next session to get a move towards 25815/25775-25765 bounce later 25730-25710 odds and that goes means 25675/25645 possible. Not able to stay below 25815 and move above 25875 could get 25910/25945 reject

Green tickz

Dec 10, 20251 min read

Daily market summary,plan charts and data of NF – 09Dec’25

DD down day with sellers advantage at close in last session. Below 25975 marked for a move towards 25895 then below 25880 expected more. They had a gap down and moved below 25975 via drive till 25875 then bounced and closed gap till mid session. After closing gap could not accept back into yday range and moved back to dVAL then closed at dPOC. 3-1-3 profile with tails at both ends and balanced profile. Sustain value area = trend else move back to other end of value area and l

Green tickz

Dec 9, 20251 min read

Daily market summary,plan charts and data of NF – 08Dec’25

Short covering auction for NF in last session and left poor profile anomaly structure with weak low. To avoid repair buyers needed to push higher early. 26280 marked as support for next session. Considered weak below this for 26250/26210/26180 bounce else 26150/26125 expected. They started accepting below 26280 early in session and got slow drive repairing poor profile of last session first till 26180 then no demand showed up and got clean extn down towards 26125 and extended

Green tickz

Dec 8, 20251 min read

Daily market summary,plan charts and data of NF – 05Dec’25

3-1-3 profile of previous session got a partial fill then gone for some two way wide range whips in IB period then later got short covering day which then pulled back to VWAP and closed above dPOC. Short covering auction. Profile left anomaly structure. To avoid repair buyers need to push higher early and once done dont accept back in value area. Weak low as well as poor high. 26280 support for next session. As long as this holds, odds to balance and move higher to get 26375/

Green tickz

Dec 6, 20251 min read

Daily market summary,plan charts and data of NF – 04Dec’25

Below 26080 or above 26150 expected first session to move well today. They had a lower open from close just below 26080 but barely stayed down and got drive up to clear 26150..Above 26150 marked a move towards 26180/26210/26240-26250 which they got quick after IB..Failing to stay above 26210 and back below 26150 expected 26120/26090-26080 which they did in mid session then bounced and closed above dPOC. 3-1-3 profile with two way balanced profile with tails at both ends. Sust

Green tickz

Dec 4, 20251 min read

Daily market summary,plan charts and data of NF – 03Dec’25

Another long liquidation day in last session with value in large buying tail of 26/11 trend day considered weakness. Considered weak below 26180 for 26120 bounce else 26080 expected. They moved down via open drive with volume straight below 26080 26/11 low and moved till 26050 then had tight balance and towards close got squeeze and closed above dVAH. Second day of long liquidation day below outside day. Left weak and poor low. Shorts got clean squeeze at close. 26080-26150 c

Green tickz

Dec 3, 20251 min read