Daily market summary,plan charts and data of NF – 05Dec’25

- Green tickz

- Dec 6, 2025

- 1 min read

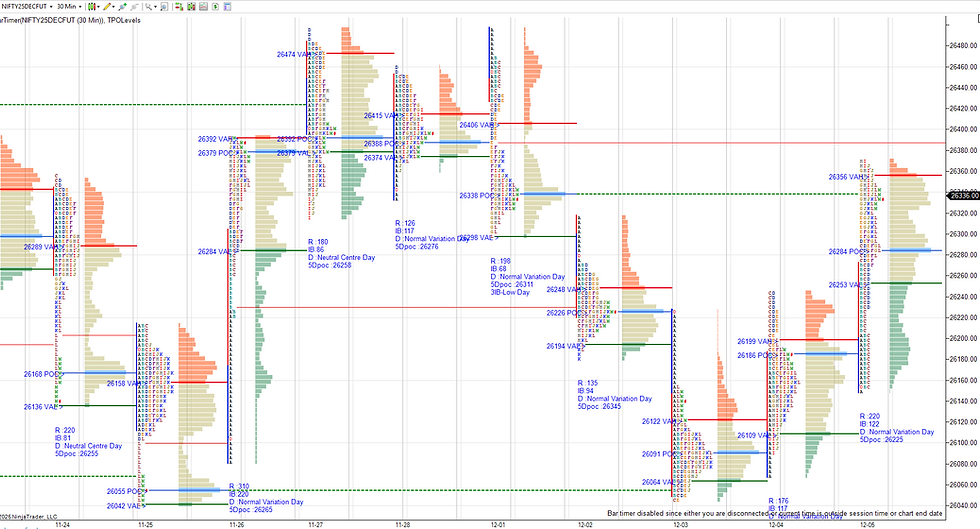

3-1-3 profile of previous session got a partial fill then gone for some two way wide range whips in IB period then later got short covering day which then pulled back to VWAP and closed above dPOC.

Short covering auction.

Profile left anomaly structure. To avoid repair buyers need to push higher early and once done dont accept back in value area.

Weak low as well as poor high.

26280 support for next session. As long as this holds, odds to balance and move higher to get 26375/26405 if sustains then 26435/26465/26495-26505 odds.

Not able to stay above 26400 and moves below 26330 means 26305/26280 odds. Weak below 26280 for 26250/26210/26180 bounce else 26150/26125 odds.

Weekly and monthly:

26300 considered support for the week which got violated via outside day at start of the week. Marked for a move down towards 26220/26080-26040 which they done in first half of week then bounced and closed at dPOC of the week.

Low volume inside week as long liquidation profile but closed at dPOC. Buyers need to start as short covering week to avoid overlap in this week value area. 26330 pivot for the week. Buyers need to push higher above this early in the week and then never accept below pivot. Holding 26330 odds to get 26410/26465 reject else 26510/26590-26610 odds.If stays above 26610 then 26700-26750 possible.

Failing to stay higher above 26400 and back below 26330 could get 26270/26200 and 26200-26150 solid support for the week. This band goes means back to 26080-26050/25975 possible.

Charts and plan :

Comments