Daily market summary,plan charts and data of NF – 27Nov’25

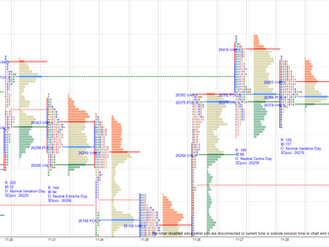

ATH print day ended as neutral center day with FA top on Thursday. Expected filling of this profile next between 26340-26490. They have gone for 26340-26460 range all day with poor volume then closed at dPOC. Inside day. Below VAL sellers need to push next..Above VAH drive odds..Gap means PDH becomes support. Moving above 26445 could get 26475-26490 and above 26510 squeeze to 26540/26565/26590/26620 odds..Anything above 26635 could get fresh leg towards 26665/26695-26710. Not

Green tickz

Nov 29, 20251 min read

Daily market summary,plan charts and data of NF – 27Nov’25

Clean trend day for NF in last session. Buyers job was to get drive/gap to get 26460/26510. They had a gap and after open auction moved to 26495 then failed to sustain above IBH and dropped. Not able to stay above 26440 and move below 26380 marked for 26340/26310 and they got 26320 then bounced and closed at dPOC. ATH print day. Neutral center auction with failed auction at top. Likely to go for filling in today profile tmw for most of session as long as holding 26340-26370 d

Green tickz

Nov 27, 20251 min read

Daily market summary,plan charts and data of NF – 26Nov’25

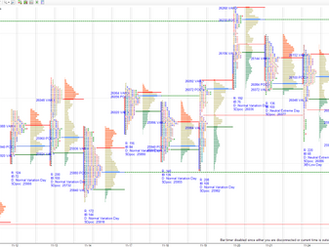

Third day of FA top + neutral extreme down day for NF with spike down close in last session. They opened higher above spike high and gone for open drive up with volume. Above 26125 marked for 26190 then above 26205 expected squeeze to get a move till 26345. They gone for this move straight till mid session till 26345 then halted and rest of session had a tight balance top above this mark high at 26390 then closed at high. Clean trend day with large buying tail with volume clo

Green tickz

Nov 26, 20251 min read

Daily market summary,plan charts and data of NF - 25Nov'25

Failed auction top + neutral extreme down day in last session with spike close. Staying below 25960 marked for 25935/25890 then bounce expected. They got only till 25935 and bounced but could not clear clear 26040 res zone then moved down to clear IBL..Then all day slow drag higher again failed to clear 26040 and lead to drag down to IBL then spike down close at low. Third day of FA top + neutral extreme down day. Spike down close. Third day of one time frame down. Holding PD

Green tickz

Nov 25, 20251 min read

Daily market summary,plan charts and data of NF – 24Nov’25

Neutral extreme down day with failed auction at top in last session and high volume rollover zone 26140-26180 marked as res to have balance and skew lower towards 26045/26015/25990. They had a balance in first session holding PDL zone for good time as open auction in first session then got push down to get 26045 which made good low with quick bounce.But later could not sustain that good low 26045 which lead to spike down close at low. Another failed auction top + neutral extr

Green tickz

Nov 24, 20251 min read

Daily market summary,plan charts and data of NF – 21Nov’25

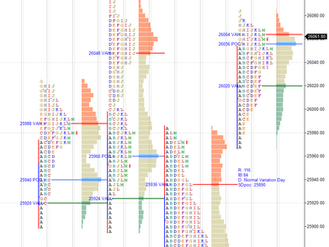

Triple disbn up day with volume for NF on Thursday.Considered weak below 26170 to get 26140 which was solid support from triple disbn auction and that goes means expected 26110/26075/26045. They got open test drive moving below 26170 straight to get PDL zone 26075 then bounced which just swiped IBH and came down again to get new low then closed at low. High vol triple disbn day got negated with another heavy volume day.Highest volume in 2-3 months got registered. Neutral extr

Green tickz

Nov 22, 20251 min read

Daily market summary,plan charts and data of NF – 20Nov’25

Outside day + Double disbn trend day up for NF in last session. Observation was that auction was incomplete at high. Expected PDH swipe to get 26145 then reject and later 26180/26220 marked for upside. And once moved away from PDH buyers expected to defend 26070. NF had a open auction whipping moves with higher open rejecting at 26145 then push down defending above 26070, gone for balance then got acceptance above 26145 which dragged it to 26180 then spiked to 26220/26260. Tr

Green tickz

Nov 20, 20251 min read

Daily market summary,plan charts and data of NF – 19Nov’25

Normal day for NF in last session. Below 25930 expected 25900/25875 and bounce to repair value area with a move back to 25935-25950 then above 25950 squeeze to 26010 then expected rejection.Later above 26010 marked for 26040/26075/26105. NF moved to 25885 bounced to 25950/26005 rejected then cleared 26010 to get 26090 then closed at dPOC. Outside day. Double disbn trend day up. dPOC skew at second disbn. Auction incomplete at high and weak high too. Defending 26030-26040 coul

Green tickz

Nov 19, 20251 min read

Daily market summary,plan charts and data of NF – 18Nov’25

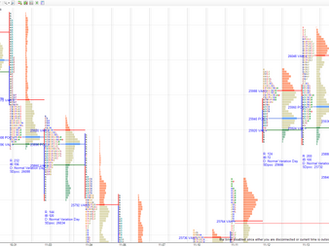

Short covering day with dPOC skew close for NF in last session.Buyers had to defend value area next else VAL-PDL zone test expected..They opened straight at VAL zone and could not sustain inside value area and gone for liquidation straight at open during IB period. Below 26000 marked for a move towards 25935 bounce else 25890-25880 expected. They got 25905 then bounced all day to get day high then at close dropped to close at dVAL. Normal day trading inside IB range all day e

Green tickz

Nov 18, 20251 min read

Daily market summary,plan charts and data of NF – 17Nov’25

Failed auction at low with neutral extreme up close for NF in last session.Directional move higher was bias next. Defending 25930 expected move higher next towards 26020/26050/26080. NF had open auction defending prev day range itself and moved to 26080 then closed above dPOC. Short covering day. dPOC skew and closed there. Buyers job to defend value area and move higher next. Failing to stay above PD range could go for overlap in value area and reject at VAL-PDL zone odds. L

Green tickz

Nov 17, 20251 min read

Daily market summary,plan charts and data of NF – 14Nov’25

Outside day for NF on Thursday. Move below 25935 marked for 25865/25835-25815 and bounce expected. Open test drive up failed and got 25840 by end of IB then gone for whipping two way auction but stayed below IBH. Later got 25815 then got clean bounce to close at high. Failed auction at low. Context wise neutral extreme up day though IB high was marginally saved at close. Volume was highest in months which confirms FA low of this day could act as potential swing low. Last two

Green tickz

Nov 15, 20252 min read

Daily market summary,plan charts and data of NF – 13Nov’25

NF got fat tail top with supply at top in last session. 26015/25965 markled as ref and below 25965 marked move till 25905 then bounce else more weakness expected..They got 25900 at open then bounced and cleared 26015..Squeeze expected above that towards 26075/26100. They got 26090 then failed to defend PDH/morning extn handle so got liquidation to test morning tail then closed below dPOC. Outside day. Upper disbn today again got supply. As long as NF not accepting above 26045

Green tickz

Nov 13, 20251 min read

Daily market summary,plan charts and data of NF – 12Nov’25

NF had a gap up today after NE day. Above 25975 expected 26010/26040. It moved to 26020 then closed around dVAH. NF got fat tail top on short covering profile today due to some solid supply at higher quad. 26015/25965 ref for next session. Below 25965 could get 25940/25920-25905 and bounce else more weakness towards 25865/25835-25815/25785/25750. Not able to stay below 25910 could go for overlap session with a bounce back to 25950/25980/26015 and that accepts means squeeze hi

Green tickz

Nov 12, 20251 min read

Daily market summary,plan charts and data of NF – 11Nov’25

Short covering profile after stopping 6days of one time frame down for NF in last session. Expected overlap between 25670-25735-25765 and considered trend below 25670 with 25710 as res to get 25625/25595/25565/25525. They got this move straight as drive at open and travelled till 25555 then bounced accepting in value area of last session. Above 25745 marked squeeze for 25770/25805/25840 and they got this move till close then closed at high. Outside day. Neutral extreme up day

Green tickz

Nov 11, 20251 min read

Daily market summary,plan charts and data of NF – 10Nov’25

6th day of one time frame down for NF in last session and staying below 25660 was looking for lower balance test of last session. Above 25675 expected move to 25735/25765. They cleared 25675 in IB to get till 25745 then stayed in tight range and closed at dPOC. Short covering profile. Stopped 6days of one time frame down. Buyers seen from lows today and defended well all day and also seen profit booking/supply from top closing with dPOC skew down. Odds to have overlap between

Green tickz

Nov 10, 20251 min read

Daily market summary,plan charts and data of NF – 07Nov’25

NF had long liquidation auction on Thursday.25675 marked as res. Considered weak below 25590 for 25535 and below that expected 25450-25435. They opened with gap below 25535 and gone straight to 25435 then bounced all day to close gap and then closed above dVAH. Lower value day closing above dVAH. 6th day of one time frame down. 45degree move away from dPOC with skewed upper balance + poor value area with anomalies in profile. Not able to get drive up/gap up calls for mean rev

Green tickz

Nov 9, 20252 min read

Daily market summary,plan charts and data of NF – 06Nov’25

Double distribution trend day down for NF in last session. Staying below 25765 expected 25650-25635/25605. They pushed above 25765 at open but could not sustain that drive and cleared low of open as well as PDL quick which pushed down to 25635..Bounced from there by mid session which failed to stay inside last session range and got 25605 for close then closed at dPOC. 5th day of one time frame down. Long liquidation auction. 25675 immediate res and 25720 strong res for next s

Green tickz

Nov 6, 20251 min read

Daily market summary,plan charts and data of NF – 04Nov’25

Short covering profile with good tail for NF on 03rd close. Defending 25860 expected balance in value area and considered weak below that for 25825/25780 then liquidation towards 25730/25690 marked. They had a open test drive down clearing 25860 early in session and got straight 25790-25780 early then later started accepting below 25780 to get 25690 by end of the day then closed at low. Double distribution trend day down closing at low. Weakness and auction incomplete at low.

Green tickz

Nov 5, 20251 min read

Daily market summary,plan charts and data of NF – 3Nov’25

NF had a long liquidation session with dPOC skew down at close with advantage sellers on Friday. Below 25885 marked for 25850/25815/25780 then bounce expected. They had a gap down and probed 25800 then bounced which could not clear days res zone 25950 and then all day gone for balance then closed at dPOC. Short covering profile after wide long liquidation range last 3 days. 3rd day of one time frame down. Clean buying tail today marks good swing support. Defending 25860 zone

Green tickz

Nov 3, 20251 min read

Daily market summary,plan charts and data of NF – 30Oct’25

NF had a solid long liquidation session on Thursday. Observation was that auction was incomplete at low. Upside 26100-26120 marked as res. Downside marked for 25950/25905/25885. They had a open lower below PDL and bounced sharp via drive at open but could not sustain above res zone 26100-26120. Rejected there and failed the drive then moved to 25890 at close then closed at dPOC. Another long liquidation session. dPOC skew down at close with advantage sellers based on data and

Green tickz

Nov 2, 20252 min read