Daily market summary,plan charts and data of NF – 07Nov’25

- Green tickz

- Nov 9, 2025

- 2 min read

NF had long liquidation auction on Thursday.25675 marked as res. Considered weak below 25590 for 25535 and below that expected 25450-25435. They opened with gap below 25535 and gone straight to 25435 then bounced all day to close gap and then closed above dVAH.

Lower value day closing above dVAH.

6th day of one time frame down.

45degree move away from dPOC with skewed upper balance + poor value area with anomalies in profile. Not able to get drive up/gap up calls for mean reversion to POC/VAL then repair this profile via two way auction.

Structure and data at close was weak.As mentioned in closing commentary pullback again to 25545/25495 due as long as not clearing PDH next.So, staying below 25660 looking for 25560-25545/25505-25490 then bounce and repair last session value area odds for next session. Extreme case test 25450 and hold.Not holding means liquidation towards 25405/25365/25325 odds.

25675 gets cleared means odds to get 25705/25735/25765+.

Swing downside marked for 25605/25520/25450. This move is over now. Likely to balance holding 25450 odds and above 25675 reversal higher possible.

Weekly and monthly :

4th week of one time frame up for weekly in last week but back to back weeks shown LL profit booking auction closing at lower quad. Odds were higher either for liquidation down week or overlap week in 2week range. 25950 then 26050 marked res for the week.

Expected move down early in the week towards 25820-25780 bounce higher else 25720-25680 odds and goes means 25600/25520 was looking for. They held below 25950 and moved well below 25520 then closed at dVAL of the week.

Downside during the week mentioned in commentary that since Oct extn singles were accepting, test of lower balance high around 25450 was due. This move is done now and got clear bounce from that Oct good demand zone. Immediate expectation now is to fill that Oct extn zone roughly between 25450-25650-25800 then move beyond for remaining weeks of Nov.

dPOC skew down on LL week and closed below that. 25675 res for the week. Staying below this looking for test of 25560/25495-25450 bounce back to 25675 odds. Staying below 25400 could move to 25300-25275 bounce else 25170/25080 odds. If 25050 not holding then 24900-24850 as spike possible. Not able to stay below 25450 and bounce means back to 25560/25650-25675 and clearing that could mark swing low for Nov to get 25770-25800/25920-25950 reject else spike to 26100 reject else slow skew higher to 26240+ possible.

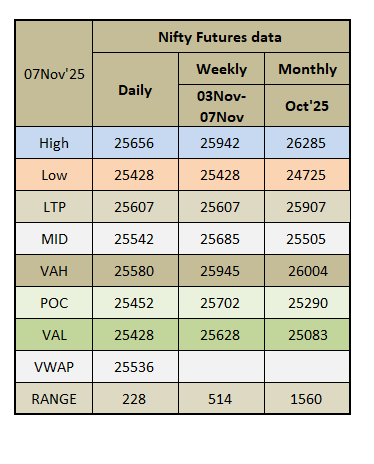

Charts and data :

Comments