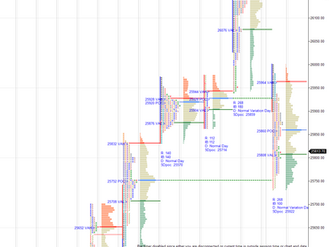

Daily market summary,plan charts and data of NF – 30Oct’25

NF had a short covering day in last session and marked 26165 as support for the decent buyers shown up. Failing to get drive up to clear PDH and moving below 26160 considered weak to get 26105 bounce else expected probe of 26060/26035/26005. They got a volume based drive down below 26160 and moved straight to 26020 by end of IB then all day had a balance holding morning tail top then closed below dPOC after making new low below IBL. Solid long liquidation session. Good sellin

Green tickz

Oct 30, 20251 min read

Daily market summary,plan charts and data of NF – 29Oct’25

Long liquidation session in last session. 26145 considered as pivot. At open via OAIR got whipped around 26145 then moved to PDH and above 26230 marked for 26265/26290 they got 26280 then closed above dPOC. Short covering day. Buying tail and some decent buying happened today. 26165 support for them tmw. Better they get drive or gap up. Failing to do so could retest 26165 zone and not able to stay below and back above 26215 could get 26240/26275. Above 26285 could get 26310/2

Green tickz

Oct 29, 20251 min read

Daily market summary,plan charts and data of NF – 28Oct’25

Short covering day for NF in last session with advantage buyers at close. Once moves above PDH expected buyers to defend POC. they got PDH swipe at open but could not sustain and gone for a move below POC which lead to liquidation. Failing to stay above 26080 and move below 26010 marked for liquidation towards 25965 then 25890/25860/25830-25815. They got this move fully today then bounced and closed at dVAH. Long liquidation session with large tail top. Poor low. Likely to ge

Green tickz

Oct 28, 20251 min read

Daily market summary,plan charts and data of NF – 27Oct’25

NF had a long liquidation in last session and opened higher above POC of last day. No rejection at 25920 means upside marked for 25980 then 26040/26080. They had a slow drive and push for IB to get 26050 then gone for tight balance then liquidation could not sustain in tail zone.Bounced and closed at dVAH. Buying tail and short covering day. Volume was good and advantage buyers at close. they may get drive/gap up and once done should defend POC if moves far away from prev day

Green tickz

Oct 27, 20251 min read

Daily market summary,plan charts and data of NF – 24Oct’25

NF closed as neutral extreme down day with spike down close on Thursday. 26010-26020 marked as res to start the session. Not able to sustain above expected to get PDL and below 25945 marked for a move towards 25890-25880 bounce hard.Staying below 25865 expected to get more liquidation towards 25835/25800/25765-25750. They held below 26000 at open to get 25900 then bounced and later failed to hold 25880 and moved to 25750 swipe then bounced and closed at dVAL. Long liquidation

Green tickz

Oct 26, 20251 min read

Daily market summary,plan charts and data of NF – 23Oct’25

NF had a large gap and gone for balance till mid session then moved down to close gap then closed at low. Barring freak high, auction wise failed auction at top. 5th day of one time frame up. Neutral extreme down day with 45 degree move away from wide dPOC. Spike down close with 26002-25950 being spike zone. Stay in/below spike = weakness and acceptance of spike high calls for mean reversion value fill. 26010-26020 res to start the session. Not able to sustain above this coul

Green tickz

Oct 23, 20251 min read

Daily market summary,plan charts and data of NF – 20Oct’25

NF had a gap and drive after a 3-1-3 profile which probed upside obj till 25970 then failed drive to close gap. After closing gap, could not stay inside value of 3-1-3 and all day gone for good two way balance then closed at dVAH. 4th day of one time frame up. Normal day trading inside IB range all day and closed at dVAH. Buyers advantage at close structure and data wise. Staying above VAH could get PDH and then 25095-26005/26030-26040 if sustains above this weekly final obj

Green tickz

Oct 21, 20251 min read

Daily market summary,plan charts and data of NF – 17Oct’25

Triple distribution trend day for NF on 16/10. Buyers job was to scale to 25680/25720 if sustains marked a move towards 25830. Open rej reverse scaled 25680 and made a move towards 25849 then pullback rejected at 25660 and closed at dPOC. 3rd day of one time frame up. 3-1-3 profile with two way balance and tails at both ends. Failing to move beyond value area could do overlap inside value area and staying beyond value area could get trending move. Buyers need to defend 25690-

Green tickz

Oct 18, 20251 min read

Daily market summary,plan charts and data of NF – 16Oct’25

Short covering profile in last session with observation that auction was incomplete at top. Since it was volume based buying in last session odds were there for more extn higher. Drive above PDH expected to get 25520 then 25595 and they got drive and trend day to mark till 25698 then seen some profit booking to close at dVAH. Triple distribution trend day. 3IB day. Profit booking seen at close. Job of buyers to defend 25630 and move higher to 25680 if sustains 25720 and accep

Green tickz

Oct 16, 20251 min read

Daily market summary,plan charts and data of NF – 15Oct’25

NF had a outside day in last session. Sustaining above 25280 marked for 25330 then 25375/25410+. They had a volume based drive clearing 25280 at open to get 25330 then got IB extn to get 25410+ then gone for balance and closed at dVAH. Short covering profile. Auction looks incomplete at top. Volume based buying today and as long as buyers defend 25340 odds to have more extn higher. Levels wise 25380 support to get look for drive or gap to get 25495/25520.If sustains 25535 the

Green tickz

Oct 15, 20251 min read

Daily market summary,plan charts and data of NF – 14Oct’25

NF opened above PDH and could not stay above 3-1-3 profile which lead to PDL swipe then stayed as trend day till mid session to clear all downside obj till 25150/25120 then bounced to VWAP and closed as long liquidation profile below dPOC. Selling tail and LL profile. Outside day. Sellers need to stay below PDL else overlap in value area and test of selling tail odds next. 25220 ref to start the day next. Holding this could test 25150-25135 bounce else liquidation towards 250

Green tickz

Oct 14, 20251 min read

Daily market summary,plan charts and data of NF - 13Oct'25

Large buying tail and short covering profile for NF in last session. They opened lower in buying tail zone. 25280 no bounce means expected 25250-25235 which they got in IB then stayed inside IB range and then failing to stay below IBL moved back to dVAH for close. 3-1-3 profile with tails at both ends and balanced value area in between. Staying beyond value area = trend else overlap and test other end of value area to look for extn next. 25280 pivot for next session. Holding

Green tickz

Oct 13, 20251 min read

Daily market summary,plan charts and data of NF – 10Oct’25

Double disbn day with skewed POC on wider disbn top for NF in last session. Buyers had to get drive or gap highe. They got clean drive...

Green tickz

Oct 11, 20251 min read

Daily market summary,plan charts and data of NF – 09Oct’25

Long liquidation day for in last session. Expected balance for few sessions. It has almost got inside day today filling last session...

Green tickz

Oct 9, 20251 min read

Daily market summary,plan charts and data of NF - 08Oct'25

3-1-3 profile for NF in last session. At open failed to stay below VAL and gone to other end of value area i.e, VAH of last...

Green tickz

Oct 8, 20251 min read

Daily market summary,plan charts and data of NF – 07Oct’25

Double disbn trend day up for NF in last session. Buyers if managed to defend POC then expected move higher above 25205 towards...

Green tickz

Oct 7, 20251 min read

Daily market summary,plan charts and data of NF – 06Oct’25

Short covering profile with spike close for NF in last session. They held spike low at open auction then started moving higher. Was...

Green tickz

Oct 6, 20251 min read

Daily market summary,plan charts and data of NF – 03Oct’25

Double disbn up trend day with good volume for NF on Wednesday with dPOC skew higher close.Not able to stay above PDH and staying below...

Green tickz

Oct 5, 20251 min read

Daily market summary,plan charts and data of NF – 01Oct’25

NF had a 3-1-3 profile on expiry day. If fails to sustain value area then overlap and look for move other side of value was context next....

Green tickz

Oct 2, 20251 min read