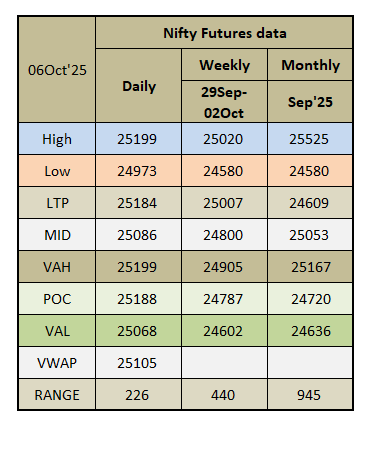

Daily market summary,plan charts and data of NF – 06Oct’25

- Green tickz

- Oct 6, 2025

- 1 min read

Short covering profile with spike close for NF in last session. They held spike low at open auction then started moving higher. Was expecting balance between 24960-25020 which they did only for open.Above 25025 marked for a move towards 25050/25080/25120/25185. They cleared weekly res 25050 then ended at 25185.

Double disbn trend day up.

3rd day of one time frame up.

Clean buying tail with volume today also good extn handle on trend day and also dPOC skew at highs. So, buyers after such trend day if gets drive/gap could defend POC all session. Fails to get such open then could go for balance between POC and extn handle and mild weakness below extn handle and major weakness only if accepts in buying tail next.

So, if no drive or gap up then odds to fill between 25120-25185 roughly and minor weakness below 25120 to test 25080-25060 which is major support for next session as well as for the week hence bounce else more weakness to test 25020 and below.

Not able to stay below 25080 could bounce and balance higher with a move back to 25125/25155/25185 and staying above 25205 could get 25235/25265-25280/25310/25340.

Chart and data :

Comments