Home

Daily market summary,plan charts and data of NF – 23Jan’26

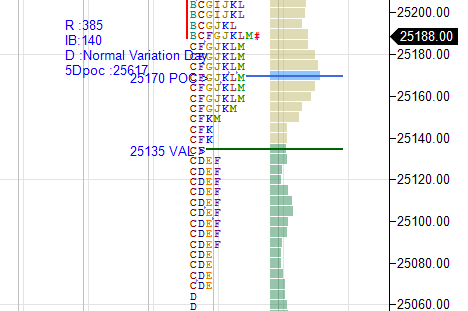

Long liquidation profile closed with rally above dVAH in last session. Buyers needed to get drive up holding VAH else overlap expected. They opened flat at LTP but could not sustain above VAH 25355 and first session gone for open auction tiring overlap into last session value area then got clean extn down then closed at dPOC. Minor weakness considered below 25340 for 25300 and major weakness marked below 25300 for 25215 bounce later 25180/25135 expected below 25215. They gone

Green tickz

Jan 232 min read

Daily market summary,plan charts and data of NF – 22Jan’26

Neutral day with heavy volume and good swing low in last session.Above 25330 expected 25395 then squeeze above 25400 marked for 25475 and that zone marked as solid res. They opened higher and got drive up above 25330 to get 25395/25475 then failed the drive and moved down to clear IBL then remained as long liquidation profile all session.Last hour seen good demand and short squeeze pushing higher to close above dVAH. Another heavy volume day almost same volume as last session

Green tickz

Jan 221 min read

Daily market summary,plan charts and data of NF – 21Jan’26

NF had a double disbn liquidation day with spike down close in last session. Expected two way fill holding below 25370 and below 25215 marked for 25120 then a move till 24975. They defended 25215 at open and bounced with drive till 25330 then failed the drive and gone below 25215 which got liquidation straight to 24965 then bounced to clear IBH..Could not sustain above IBH and gone down then settled at dPOC. Neutral day. Failed auction at top. Large buying tail with volume. 3

Green tickz

Jan 211 min read

Daily market summary,plan charts and data of NF – 20Jan’26

Balanced weekly profile resolved down in last session with neutral day. Staying below below 25635 expected weakness to continue to test PDL then liquidation marked for a move till 25420. They had a open test drive down to clear PDL at open staying below 25600 and reached 25420 by second session.Below 25450 weekly view was for spike down to get 25330/25250 which they in last hr and then closed at low. Almost a 3IB down double disbn liquidation day with spike down close. 25370-

Green tickz

Jan 201 min read

Daily market summary,plan charts and data of NF – 19Jan’26

It was neutral center day with incomplete auction at close in last session and expected to clear PDL and move down next. Staying below 25720 marked down move towards 25595 then 25535/25490. They had gap down held gap and gone down to 25530 then got tight balance, then bounced to clear IBH failed to sustain then dropped to close at dPOC. 3rd day of neutral center close. Failed auction at low. Gap down and gap held into close. Balanced weekly profile resolved down as of now. St

Green tickz

Jan 191 min read