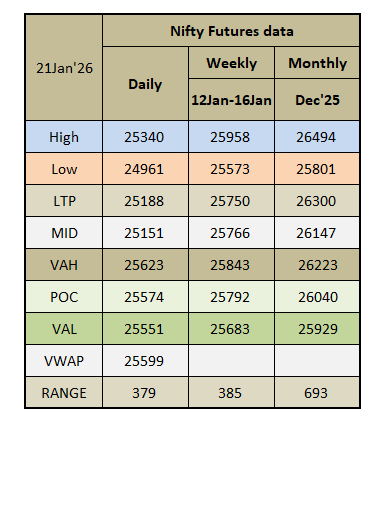

Daily market summary,plan charts and data of NF – 21Jan’26

- Green tickz

- Jan 21

- 1 min read

NF had a double disbn liquidation day with spike down close in last session. Expected two way fill holding below 25370 and below 25215 marked for 25120 then a move till 24975. They defended 25215 at open and bounced with drive till 25330 then failed the drive and gone below 25215 which got liquidation straight to 24965 then bounced to clear IBH..Could not sustain above IBH and gone down then settled at dPOC.

Neutral day.

Failed auction at top.

Large buying tail with volume.

3rd day of one time frame down.

Day registered 108 L highest volume since Oct and data was also with buyers at close. Potential swing low/excess as long as this tail holds and swing wise could push higher towards 25300/25370/25440-25475 minimum.

25130 support for next session. Holding this and bounce above 25195 could get 25230/25265 reject and later acceptance could get 25295/25330 if sustains 25365/25395 odds. More squeeze above 25400 for 25435/25475 solid res zone if accepts 25510/25545 possible.

Minor weakness below 25130 for 25100/25070 bounce..If stays below 25070 then 25040 and major weakness below this for 24995/24965 goes means another liquidation for 24925/24895/24860/24830.

Chart and data :

Comments