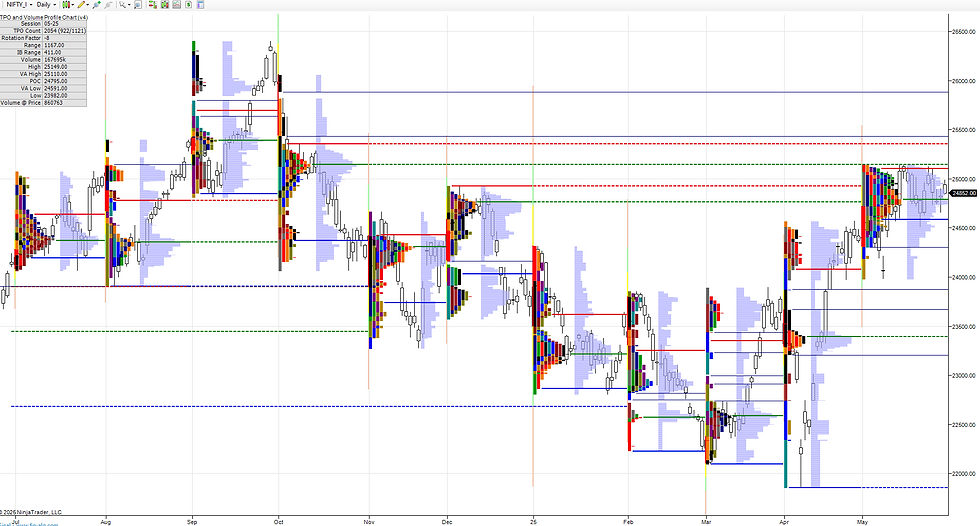

Daily market summary,plan charts and data of NF -30May’25

- Green tickz

- Jun 1, 2025

- 1 min read

Inside day and long liquidation profile for NF on Friday.

Closed at dVAL with weakness. Not able to scale above 24900 and staying below 24850 likely to get lower skew down for next session towards 24765 then sustains means odds to get further down towards 24700/24650.

Staying above 24900 could get short covering profile with PDL negation towards 24965/25020/25070 and more.

Weekly :

Balanced week and 3rd week of overlap in same range. Likely to resolve this week.

24965 pivot for the week. Holding that looking for move down towards 24765/24650 bounce else 24560/24460/24350 extreme case 24150/23975 odds. Staying above 24965 could get 25020/25070/25150/25240 extreme case 25350.

Monthly :

Two back side months then now short covering month for NF. Early next week not clearing above 25100 means likely to drop back to 24700-24650 bounce for bell balance month..Staying below 24650 could get 24500/24250/24050 to get long liquidation month. Above 25100 could get 25250/25350/25500+ as trending month.

Charts and data :

Comments