Daily market summary of NF and charts, data of NF & BNF -31Oct'24

- Green tickz

- Nov 2, 2024

- 2 min read

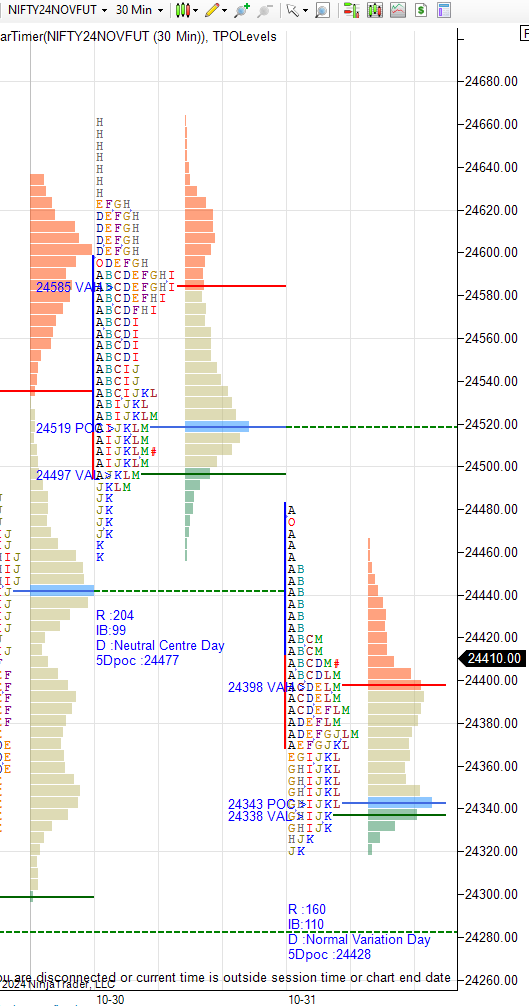

Failed auction at top with NE down day on Wednesday for NF.Buying tail acceptance means expected move back to 29th low.Considered weak below 24320 for 24280/24240/24195/24160 and NF gone for slow trend day to probe till 24190 then turned into b and closed at dPOC on last regular session.

Long liquidation profile closing below NE day as well as below swing support zone 24270 on Thursday.Adjusted to Nov 24410 now resistance for next session. Not accepting above this, could get overlap to downside auction to get 29th low zone 24310 swipe bounce possible. Value below 24310 could get more liquidation.

Acceptance above 24410 could get some slow squeeze higher atleast for first session to get PDH zone 24470-24480 if sustains then 24550 VWAP of 30th zone then FA zone of same day around 24650 probe possible.

Levels wise for next session, failing to stay below 24320 and back above 24360 could get 24395-24415 bullish above that for 24445/24470-24485 then rejection possible.If sustains 24505 then 24540-24555 pause then 24590/24630-24650 probe. Not able to stay above 24445 and back below 24380 could get 24345 weak below that for 24305/24270/24240.

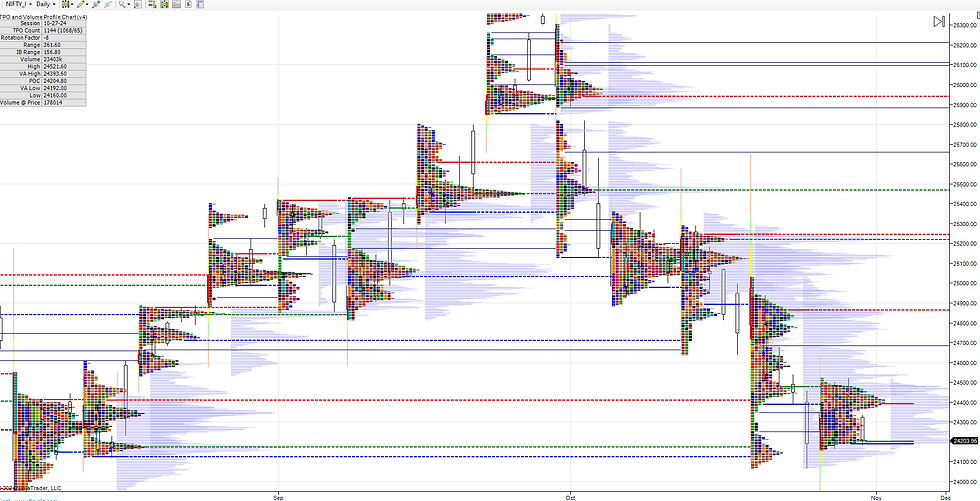

Weekly :

With large tail and IB range at end of last week after probing 24070, mentioned that some sign that climax move happened there so odds for some balance as long as that Friday low holds..Holding 24075 expected for balance and skew higher for the week towards 24280/24350/24420 reject else 24490/24550 rejection expected. They balanced the week in range between 24160-24520 then closed at lower quad.

24410 resistance to start the week to look for test of 24320-24280 zone then bounce back higher and above 24410 could get 24470/24550/24650 then rejection odds.If sustains 24650 then 24730/24820-24850 then check there..Anything above 24850 could get easily 24950/25040.Weakness below 24280 to get 24200-24150 bounce else 24050/23950 and spike below that for 23860 / 23770 / 23665 / 23550/ 23450.

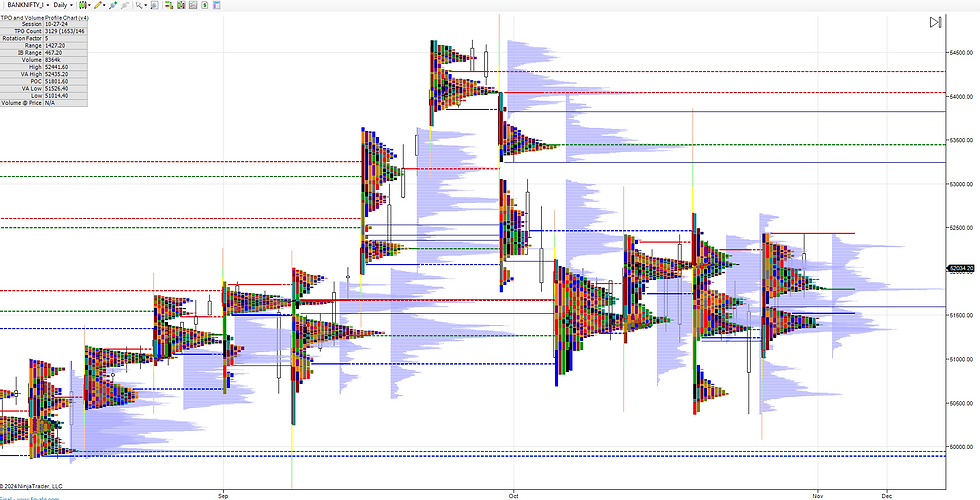

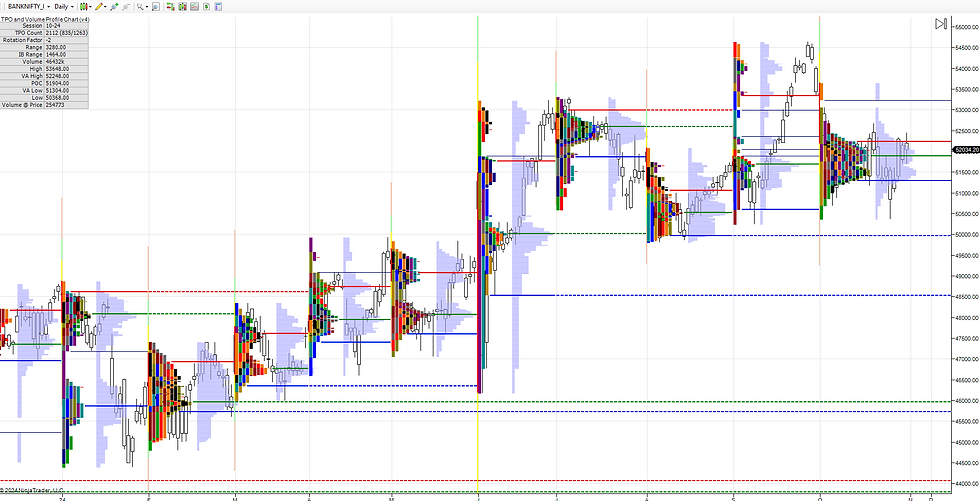

Monthly :

Oct ended as long liquidation profile closing at dVAL.Holding 24050 could balance roughly between 24050-24350-24480-24650 if accepts then 24850 spike to 25050-25150 pause/rejection later that goes means 25350+ then decide. Weakness continues below 24000 for Nov towards 23850/23665/23450.

Charts and data :

Daily

Weekly charts :

Monthly charts :

Data - current month and next month :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments