Daily market summary of NF and charts, data of NF & BNF -03Oct'23

- Green tickz

- Oct 3, 2023

- 1 min read

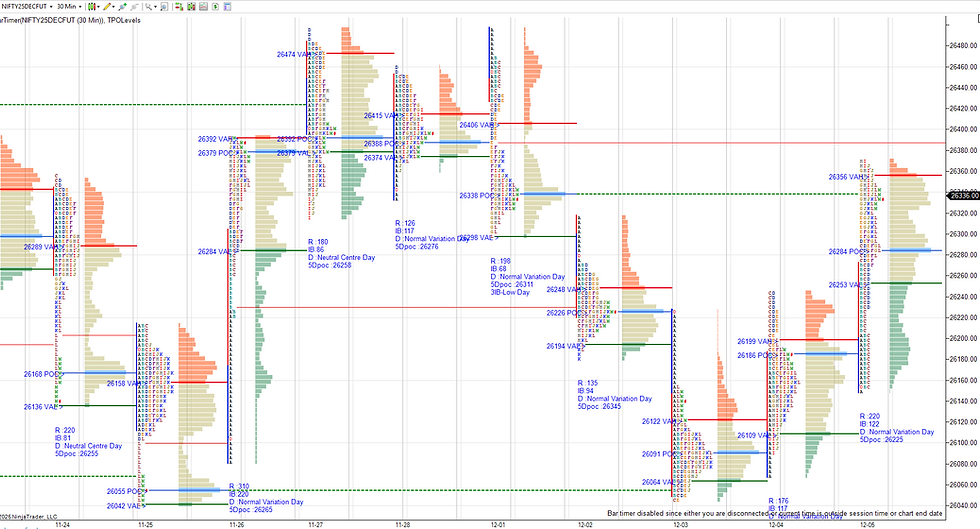

NF printed inside day in last session and structure was suggesting for some balance. Weakness expected if sellers able to push below 19650 in next session. NF opened at PDL and gone below 19650 straight at open then had a slow drive down. Marked for 19555-19540 below 19645 which NF got in IB period then all day remained as long liquidation profile i.e, sold on bounce then closed at dVAL.

Normal day with large selling tail.Cleared below last month low. Today's auction started fresh swing move as we started moving below 19620 declining odds for any balance.

As said in weekend report as well as in commenary, with a move below 19620 today, downside swing opened up for 19460/19420/19360 holding below 19700 now.

Long liquidation b profile..More liquidation below this profile..Buyers need to defend around PDL zone and move above 19600 early in the session to gain strength.

Levels wise for next session, move above 19605 could get 19630/19660-19680 if sustains above 19695 then 19720/19750 possible. Move below 19540 could get 19515/19480-19465/19435-19420 then bounce possible. Sustains below 19410 means 19380-19365/19320/19290 probe possible.

Charts and data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments