Daily market summary of NF and charts, data of NF & BNF -01Aug'24

- Green tickz

- Aug 1, 2024

- 1 min read

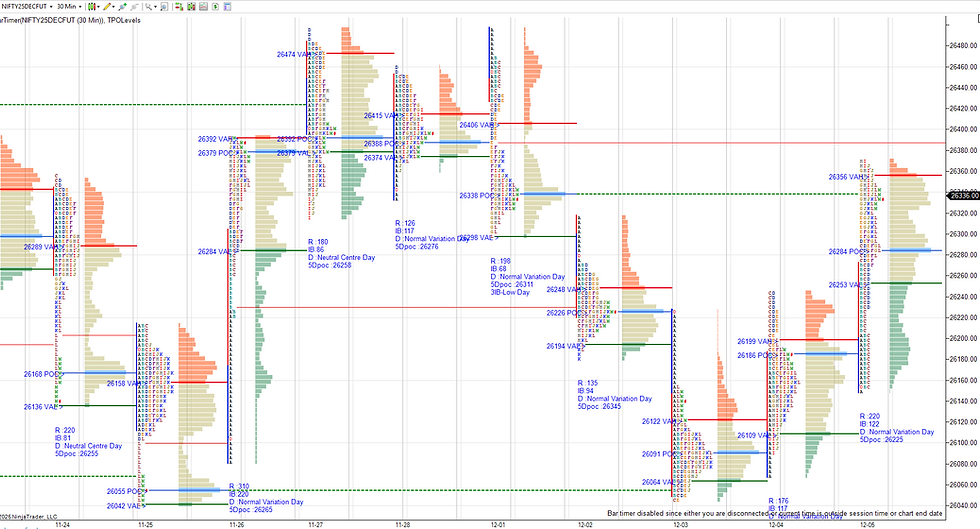

NF had a short covering profile closing above 3days of balance dVAH with advantage buyers in last session. Drive or gap expected to get fresh auction. They got gap as well as drive with volume to move higher quick but failed the drive in IB itself and then gone for one time frame down till mid session then turned into b and closed in tight range around dPOC.

Selling tail and long liquidation auction.

Move back into 3days balance value area and held at POC of the same. Focus next session how good they hold around 24990 to move back higher into today long liquidation profile. Not able to push higher and accepting below 24990 could get quick drag towards unfinished job at 24925 in 3days balance then could decide around there.

Weekly got wide POC around 24990 hence that could act as pivot for next session.

Levels wise, not able to stay below 24990 and move above 25020 could get 25045/25080 bullish above that for 25110/25140 if sustains 25180/25210/25240 odds..Not able to stay below 24915 and move above 24990 could get 25020/25045/25080/25110/25140. Not able to stay above 25050 and moving below 25000 could get 24970 weak below that for 24945/24920-24910/24880-24865 bounce else 24835-24825.More weakness below 24820 for 24790-24780/24745-24735.

Charts and data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments