Daily market summary for NF and charts, data of NF & BNF -07Apr'21

- Green tickz

- Apr 7, 2021

- 2 min read

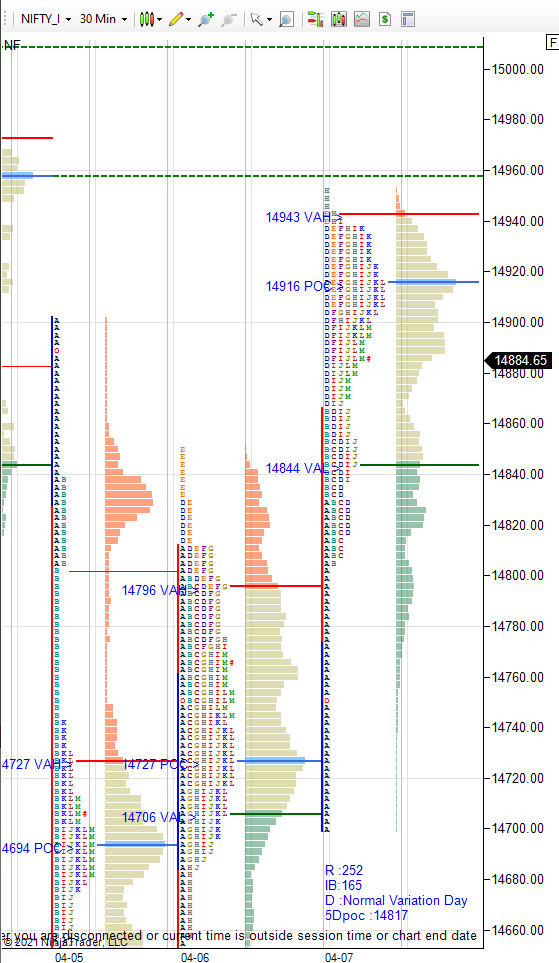

NF had a inside day auction with 3-1-3 profile in previous session. Before policy decision expected entire probe of value area based on 3-1-3 profile context. NF had a open test at VAL and got a drive up to get to VAH quick for a 100 pointer move at open. Above 14770 probe was for 14840 which happened in IB period and then above 14855 probe was for 14935 if sustains then 14975 expected..NF made a move post IB period till 14950 and then trend day move negated and turned out as short covering profile which closed below dPOC.

NF had a large buying tail today which cleared last two days high. Such large tails within large balance are likely to be probed again..Unless we get acceptance above 14975 next this could take place in coming sessions.

It was trend day in first session and then turned out as short covering profile..Its buyers job to sustain higher above 14940 with value else we could look for mean reversion move down after this short covering profile..

Swing ref 14840 triggered mariginally yesterday and another test expected to give a move higher which happened today and now negation for this swing long moves to 14810 to look further higher..Failing to scale higher and break of 14810 could look for probe back to lower quad of 05th Apr profile around 14600 zone in coming sessions.

After trend day of 30th Mar got negated badly on 31st Mar, mentioned that balance to continue for few sessions..We are in that balance now in last 4 sessions in the range of 14500-14975 now..Now, again we have signs that balance to continue with last few days of profiles in the form of b, 3-1-3 and P.. All these profile structures are suggesting buyers and sellers still fighting for control and inventory and no decisive control by one camp.So, probably few more sessions of balance and mean reversion moves to continue.

NF left a poor value area today and likely to be repaired in next session.

Price wise, 14850 support tomorrow..Failing to sustain below could bounce back to 14880-14910/14940/14975..Quite bullish above 14990 for 15030/15075 if sustains then 15130-15160 probe possible..

Failing to sustain above 14975 could test 14920/14870/14840 and quite weak below 14840 for 14810/14760/14710-14690.. Below 14680 sell off could take place towards 14610-14580/14550-14520.

Charts and data :

Detailed plan with references to carry forward, trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments