Daily market summary for NF and charts, data for NF & BNF -06Nov’20

- Green tickz

- Nov 7, 2020

- 2 min read

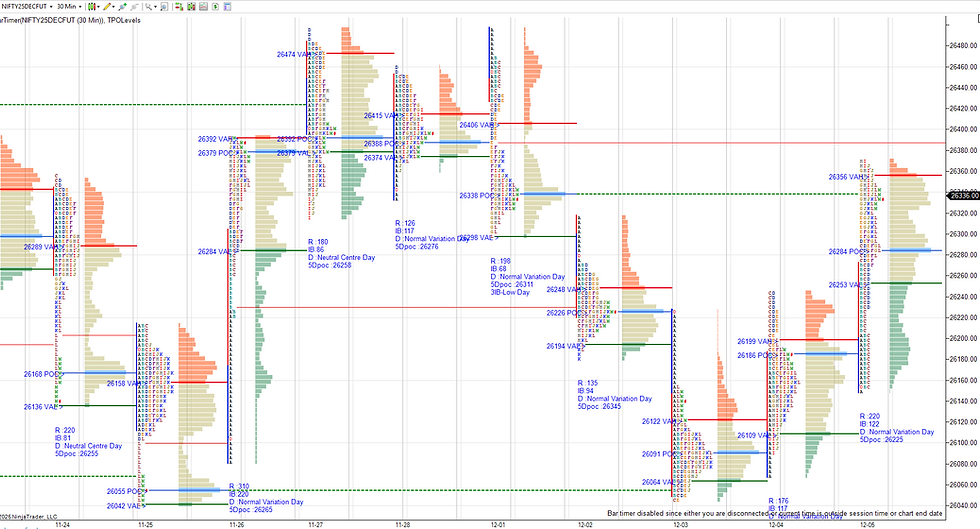

NF has established sign of incomplete auction by close and expected a follow through further from Thursday profile. Holding above 12130-12100 band, probe was for 12170/12220-230/12260 zones.NF held 12130 during OAOR and gone to complete all the probe zones and closed at dVAH.

Info from Friday auction :

NF registered 5th day of one time frame up.

NF had left a poor value area and dPOC skewed to dVAH by close on such profile..Its important for buyers to quickly move away from this profile to avoid repairing poor value area after such dPOC shift. Failing to do so and acceptance below POC, could go for repairing entire value area.

Upper disbn above 12230 gone slightly wider than lower disbn of the day with rotation factor of 14.And, intra auction has closed extn handle as well as tested VWAP but gone for new day high by close. With all these nuances + dPOC shift by close, its apparent that buyers mechanically pushing higher here and wants to complete the auction quicker. This structure suggests, we are close to end of auction of this rally and could return to mean reversion soon..Without doing balance/repair of this profile, if NF goes further then its time to be cautiously bullish.

12250 POC of the day is good ref for buyers to hold and look for PDH scale earlier in next session to get 12310-12330/12355 and looking for balance if fails to sustain above 12355..Further bullish above 12375 for 12410-12420/12450.

Weakness below 12250 to test 12200-12180 if sustains could probe 12150-12140 and quite weak below 12120 for 12095/12050.

Failing to sustain above 12350 or below 12250 could result in balanced day.

Larger picture :

Weekly :

After overlap at top from few weeks, expected a 11450 probe holding below 11700-11740. NF held only for a day last week below 11740 and then started accepting above 11740..Above 11740 expected a move to 12050/12250 and NF has done the same this week..

NF printed a multi distribution week moving way away from value..Its important for buyers to stay away from this weekly profile with higher value in first few days of the week else could go for balance in upper disbn of last week till 12050/12000 zone..As long as 12000-11950 zone holds, weekly is in bullish to sideways bullish trend. Weakness only below 11950 for 11750/11600.

Monthly :

Just started as trending profile and could remain as bullish to sideways as long as staying above 11850-11890 band and we will cover more on monthly time frame once it matures further next week.

Charts :

Daily

Weekly

Monthly

Data

Detailed plan with refs to carry forward, trade hypos and nuances from the day are available to members.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments