Daily market summary,plan charts and data of NF -14Aug’25

- Green tickz

- Aug 16, 2025

- 1 min read

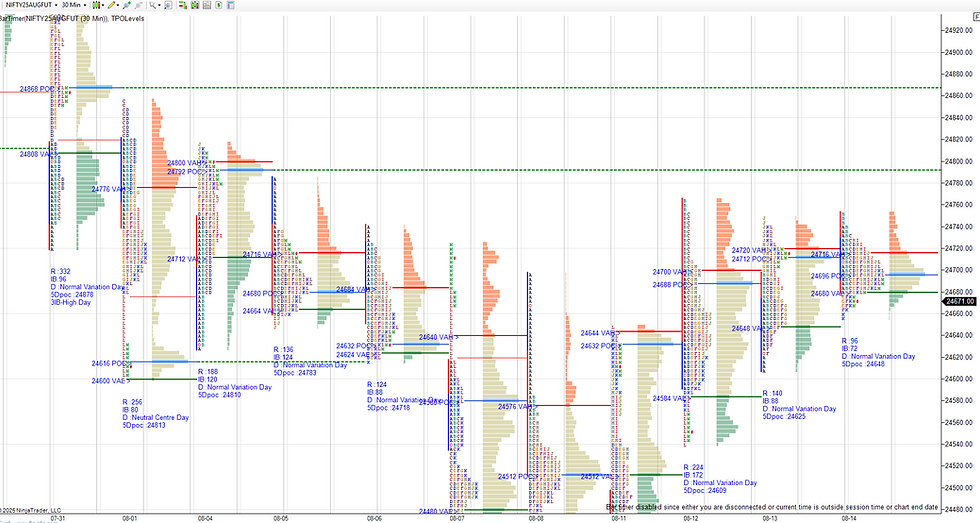

Inside day for NF on Wednesday with dPOC skew higher hence considered advantage buyers.

24680 marked as ref to hold to look for drive higher towards PDH then squeeze. They held 24680 during open auction then pushed for PDH test but rejected there at 24750 then all day gone for tight balance then closed at dVAL.

Balanced profile.Likely to get imbalance next.Sustaining value area could trend and failing to do so could move to other end and could look for trend that side.

Staying below 24680 could get 24650/24620 major weakness only below 24620 for 24585/24550-24540/24490. Not able to stay below 24650 and back above 24690 could get 24725/24760 then squeeze higher towards 24810 pullback then later 24860+ odds possible next.

Weekly :

Inside week after 5 weeks of one time frame down with weak low 24410. For the current week 24680 pivot. Staying below it could get 24620/24540/24485-24450 bounce and not able to stay below 24685 could move higher towards 24760/24850/24930-24960 then decide there.

Monthly :

July was overlap month and Aug sofar overlap lower value area in making. Aug seems likely to fill 24400-24850 in coming sessions and squeeze higher towards 24960 above 24850 and stays up above 24960 means 25050/25200/25300 as spike close odds. Below 24400 could get 24300/24150/24050.

Chart and data :

Comments