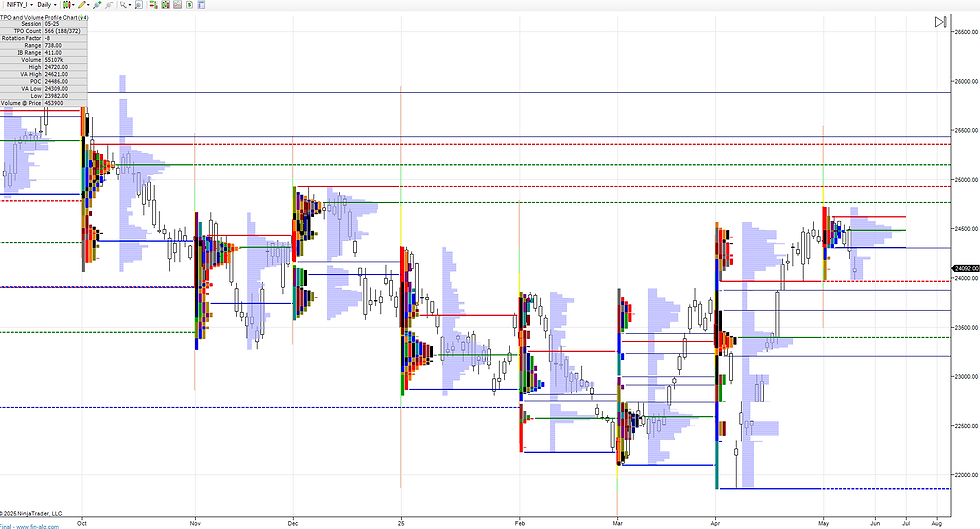

Daily market summary, plan, charts and data of NF – 09May’25

- Green tickz

- May 11, 2025

- 1 min read

NF had a gap down post DD down day and closed gap quick then all day gone for balance inside first 15mins range then closed above dPOC.

24000 mechanically saved intra and this becomes support for next session. 24160 resistance. Inside this range price stucks means overlap again.

Volume was heavy in last session despite normal day. Hence odds for imbalance from this profile.

Swing res 24380 to look for overlap and downside skew and that goes means higher move to test last week higher quad zone.

Weekly :

3rd week of one time frame up and two way balanced week closed at dVAL last week. Sellers advantage at close and pivot for the week marked at 24465. Above that expected 24570 reject else 24640 and above marked. They got 24630 at start of week then did overlap swiping 24465 pivot then closed down towards end of week to get 24000 zone then closed at lower quad.

DD down week with close at lower quad. 24160 immediate res and goes means 24240/24350-24380 reject else test 24450-24465 accepts means 24560 reject else 24640/24740/24850/24975/25130/25250 odds. Failing to stay above 24465 could rotate back to 24350/24240/24160/24050 bounce odds and staying below 24000 could get 23900-23850 and more downside towards 23650/23550/23450..

Monthly :

Monthly sustaining above 24500 rally expected and able to do so fill back between 24000-24150-24240-24500 expected. they could not sustain above 24500 and got a fill back till 24000. Liquidation odds below 24000 for 23850/23650/23500.Holding 24000 May is for 24240/24350/24450/24560 reject else 24650/24740/24850 then spike to 24975/25130/25250.

Charts and data :

Comments