Daily market summary of NF and charts, data of NF & BNF -28Mar'25

- Green tickz

- Mar 29, 2025

- 1 min read

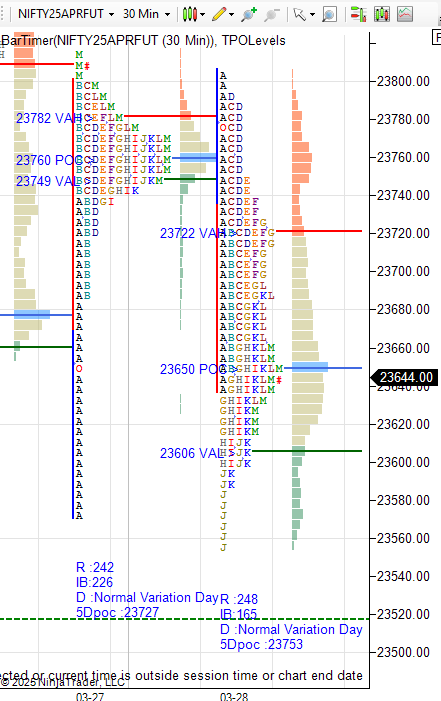

Large buying tail and short covering profile for NF on expiry day.Buyers had to get early follow through above 23800 for bullish session to get 23840/23880-23900 and failing to do so expected drop to test 23740 if sustains then slow drag towards 23695/23660 bounce else 23600 expected. They dropped below 23740 at open failing to scale above 23800 and later post IB bounce also failed to clear 23800 then all day moved down to swipe below 23600 then closed at dPOC.

Cleared large buying tail of expiry day and left another buying tail at close in last session.Buyers need to defend this tail and stay above 23680 next session for overlap session else liquidation odds.

23800 good res..and any acceptance above that could lead to short squeeze to retest excess top.

Check plan below for trade hypos.

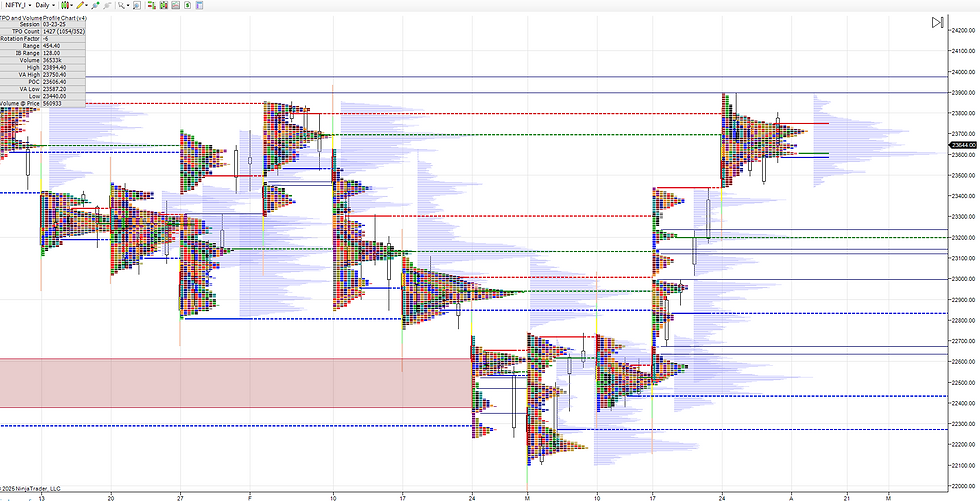

Weekly :

Elongated week it was for NF last week. Expected upside towards 23520/23630 and they got that this week. Bell balanced profile now with excess top and close at lower quad. 23520 support for the week. As long as that holds could look for balance and skew higher towards 23750/23860 then squeeze towards 23935/24040 pullback else 24150/24300. Weak below 23520 towards 23420-23380 bounce else 23300-23250 test and solid support.Goes means quite weak to get 23150/23020-22980/22800.

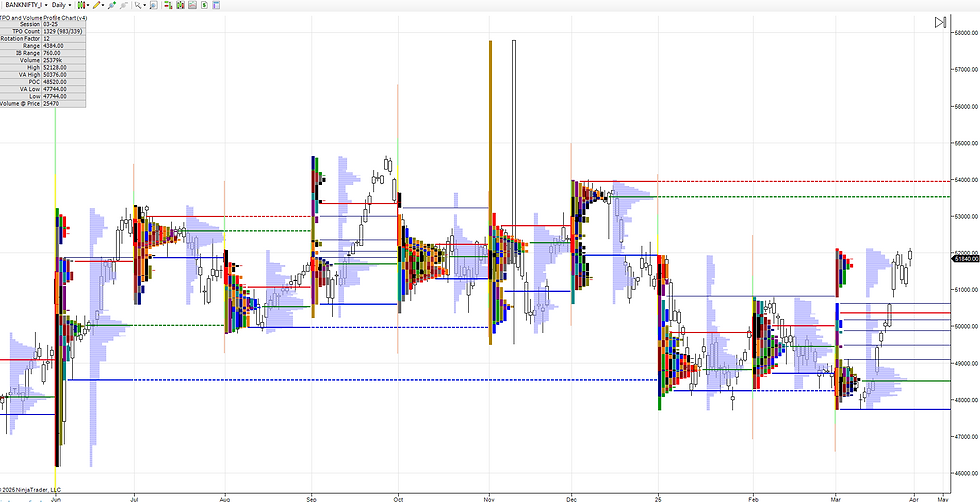

Monthly :

March turned out at outside month now. 23500 pivot to start Apr. Holding this upside towards 23750/23850 if accepts 24000/24150/24300/24450 odds. Below 23500 could get 23380/23250 bounce else 23020/22800 possible downside.

Charts - Daily :

Weekly

Monthly

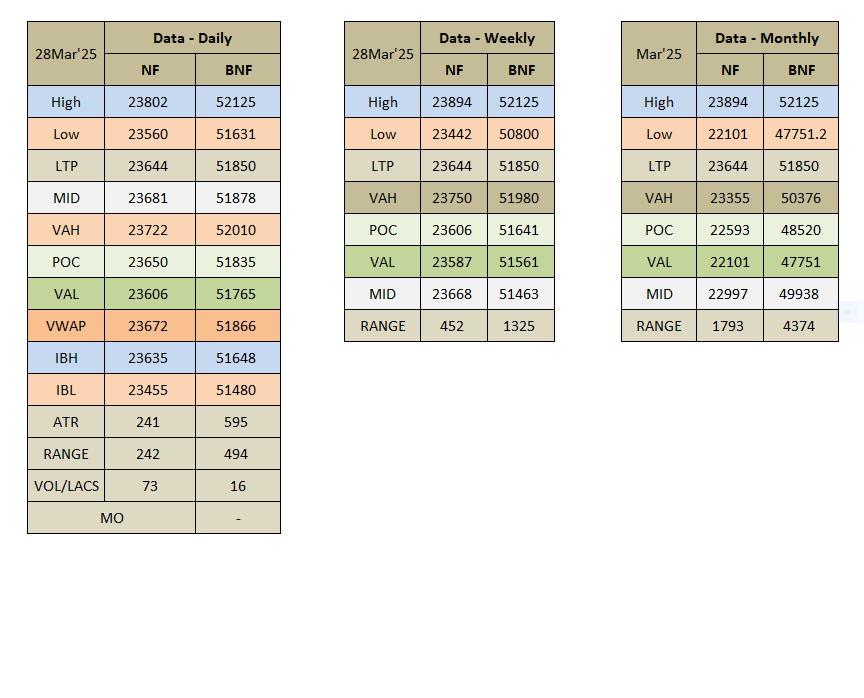

Data :

Comments