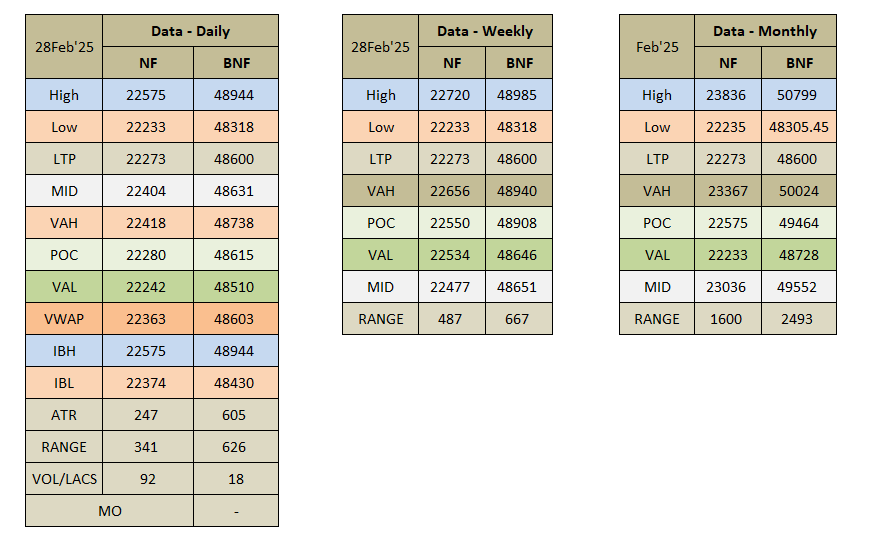

Daily market summary of NF and charts, data of NF & BNF -28Feb'25

- Green tickz

- Mar 2, 2025

- 2 min read

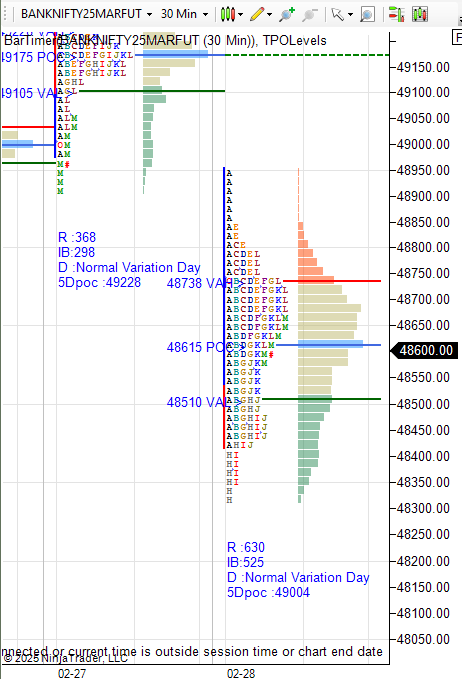

NF had a clean gap down and gone for tail then all day stayed down.

Double distribution down day with good volume.

6th day of one time frame down.

dPOC skew down at close into lower distribution and closed there. Sellers need to overlap in lower disbn and push down further for follow through..Failing to stay below PDL and accepting above POC could push back for balance to test extn singles/upper disbn/selling tail of last session.

Check plan below for trade hypos.

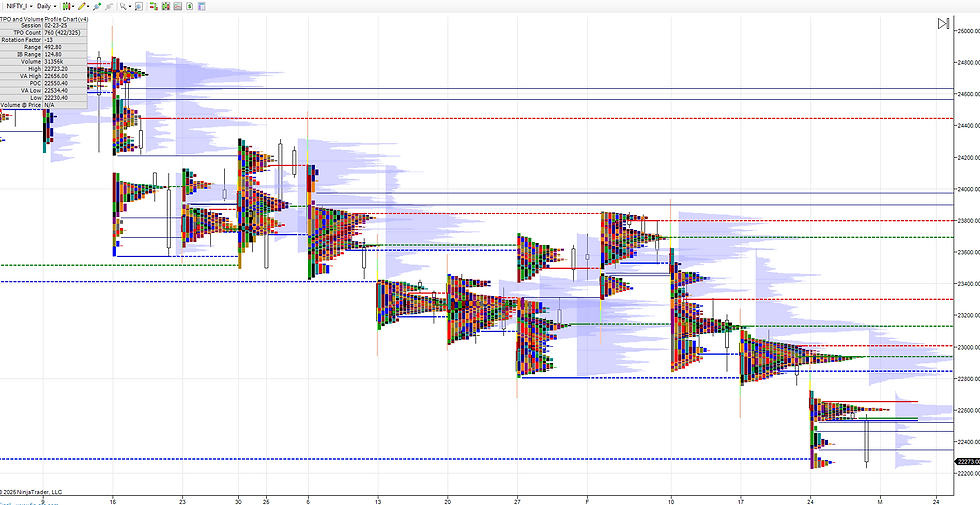

Weekly :

After last week close, holding below 22950 expected move down towards 22720/22665 bounce else 22590/22535-22500 marked as solid support zone and below that expected 22265 probe. They got 22720/22535 by mid of week then cleared that support to close the week down with 22265 probe.

3rd week of one time frame down. Weekly profile suggests one time frame down may stay this week also either by balance and skew down or one more push down then bounce and balance in lower disbn of weekly range. Sellers need to defend 22370 and sustain below 22240 so that 22185/22120/22050-22010 possible then bounce could happen. Clearing 22370 could get 22440/22520 reject else 22620/22690 reject else weekly one time frame stop move towards 22850/22940/23020.Spike down if 22010 goes means to get 21920/21810-21785.

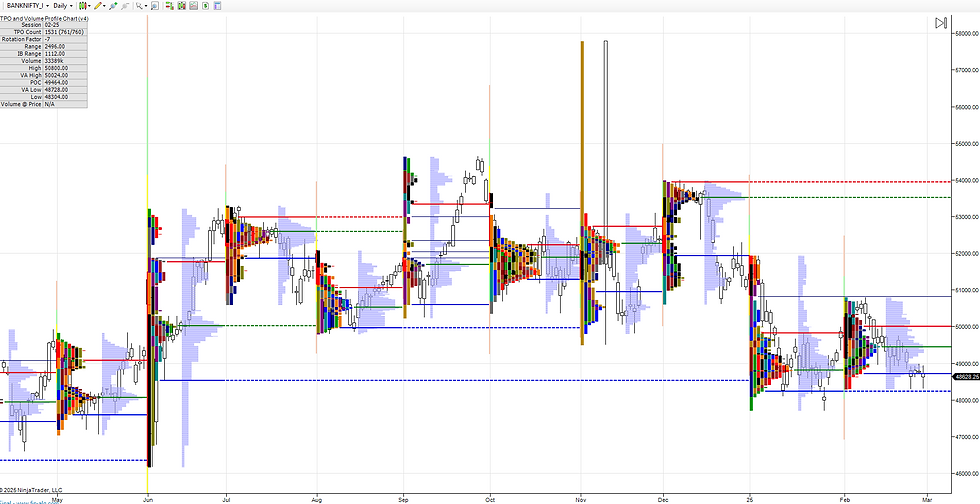

Monthly :

Monthly Feb downside extends means marked for 22550 hold then spike down close for month towards 22300-22250/22050 expected. They got till 22250 and closed Feb with spike. 22700 immediate res for Mar and 23000 solid res for Mar. 22050-22450-22700 roughly balance odds as of now for Mar and below 22050 daily values could go for another good cut downside towards 21850-21785/21650/21450-21400.Above 22700 odds to get 22850/23000/23150/23300 then decide.

Charts :

Daily

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments