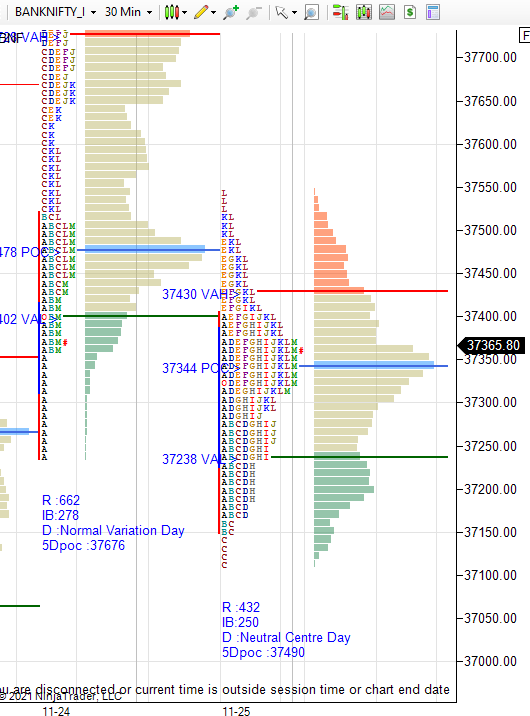

Daily market summary of NF and charts, data of NF & BNF -25Nov'21

- Green tickz

- Nov 25, 2021

- 2 min read

In last session NF stopped one time frame down as well as got neutral extreme spike down close..With such contra info, expectation was that balance to continue with mean reversion moves. If unable to stay lower below spike zone then expected balance in spike. NF failed to sustain below spike zone and gone for clean balance in spike zone then accepted above spike zone to get double distribution trend day closing at upper quad around dPOC.

Any rise upside expected to get exhaustion/rejection around 17450. Failing to scale above 17450 and move below 17400 probe was for 17360/17320. NF got this in rejection at morning open auction at 17450 zone then moved down till 17345. Later spent time in spike zone to create value and accepted above spike high 17450 to move closer to the POC zone of yesterday 17555-17565.

Pointers from the day :

Strong demand zone 17300-17320 defended the auction today with buying tail. Thats the lower end of balance we have kept and it responded today.

NF negated emotional spike down of yesterday. Some ease of supply as of now.

It was clean double distribution trend day with rotation factor of 14 and dPOC shift into close.Considering that we are making lower balance in long liquidation week, this is stretched auction upside based on this profile structure of the day.If buyers of this dPOC shift are committed and today's move is not due to expiry then they need to defend POC zone and should move higher earlier in the day..Failing to scale or sustain higher could go for filling back today's double distribution day.

17565-17580 support for next session.Failing to scale below and back above 17630 could get 17665/17690 and quite bullish above 17690 for 17730-17750. If fails to sustain below 17540 and scales above 17600 then could get 17630/17665/17690.

Weak beow 17565 for 17535/17490-17480 and quite weak below 17470 for 17435/17390 if sustains further then 17350-17335 probe possible.

Charts and data :

Current month

Next month

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments