Daily market summary of NF and charts, data of NF & BNF -01Jul'22

- Green tickz

- Jul 3, 2022

- 3 min read

NF had a overlap session and formed 3days composite closing at dPOC on Thursday.. Observation was that balance in 15700-15950 done and imbalance move possible and bias was for downside. NF had a mild gap down then resolved downside quick. Probe was for 15650/15600/15560/15520/15450 below 15720 and NF probed till 15520 then bounced to close with spike up at day high on Friday.

NF had failed auction at low.

It was neurtral extreme up day closing with spike up testing last 3days balance POC zone.

3days balance resolved downside to look below 15680 and accepted back in that balance now with spike.

All above info infavour of buyers as we had good volume also..Buyers for next session should defend 15700-15740 and look for follow through higher above spike close to get to other end of that 3days balance 15860 then should start creating value higher above 15820 which could bring in all session bullishness.

Spike rules apply for next session. 15735-15785 spike zone..Accept in spike zone / above spike zone = bullish ; Sustain below spike zone = weakness.

Failing to sustain spike zone and accepting below 15700 could go for retest of VAL 15570 /FA at low 15520.

Larger picture :

Weekly :

NF ended with higher overlap week with wide POC at 15780 and if we merge last 3weeks profile then again same 15780 acts as wide POC for merged 3weeks. And, with daily structure of FA at low and spike close with volume, buyers job to sail higher early in the week defending this 15780-15750 to probe 15860 then sustains means easy job to get 15950/16010-16050.Then one pullback possible which should defend 15850 or worst case 15750. Further acceptance above 16050 could probe 16140-16180 to close gap then 16240 possible.. From here again pullback possible to get 16050/15950/15850-15800. If sustains 16240 then 16350-16370 next zones to probe..

Acceptance below 15700 calls for 15600/15500-15450 if sustains then 15350 swipe then one pullback higher then 15200 easy move next..If sustains then straight to 14900.

Monthly :

June had expecation to get 15950/16050 then close lower defending 15700. This is done now.. June delivered double disbtribution down profile. Long liquidation month again after clean b in May as well as DD down in Apr..So back to back 3 months of long liquidation profiles now.. Things from here could go two ways a) defend 16050-16200 zone and rotate in 16200-15700-15300 roughly for sm time then take directional move or b) get one way move higher towards 16200-16250/16500/16650-16750 in first half of July to test DD higher quad of June then rotate down to 16200-16050 lower end of upper disbn of June.

Scenario A based on accepting in last month lower distribution to get second part of the month to get range extn down from 15200..Scenario b based on context of 3 LL profiles hence get one short covering profile kind of P.. So, for scenario A to take place, we should not get any bullish strong rally next week..If that happens then odds are there for scenario b..

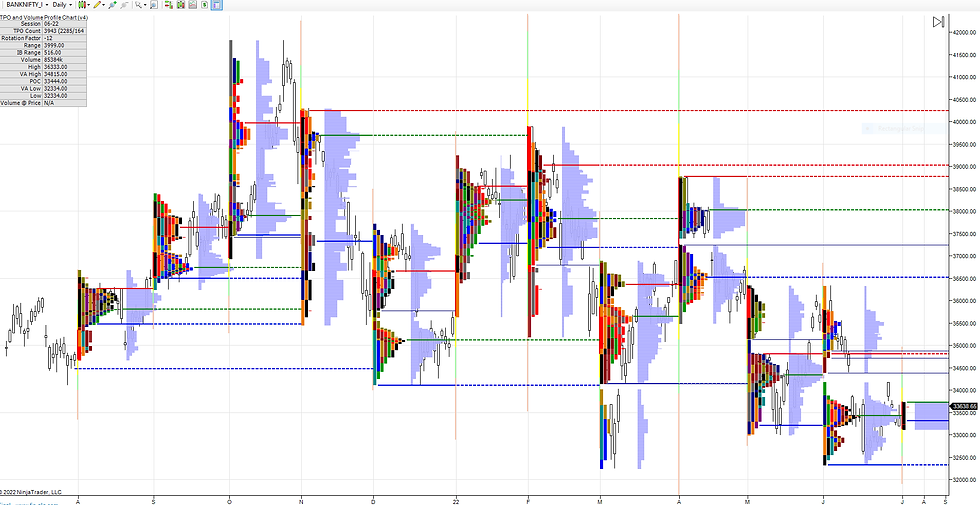

Charts :

Daily

Weekly

Monthly

Data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments