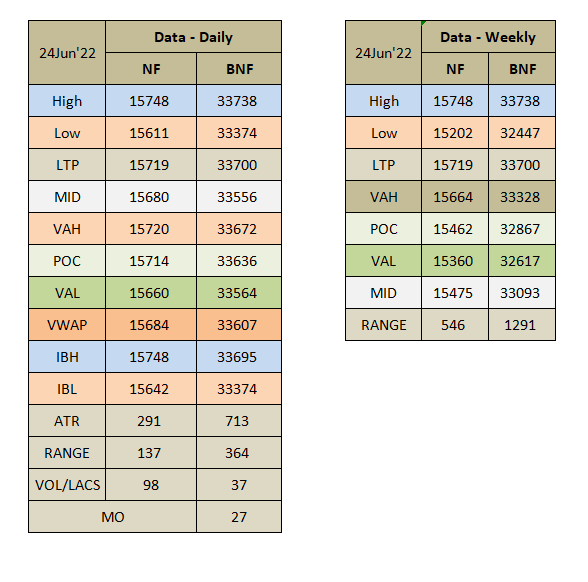

Daily market summary of NF and charts, data of NF & BNF -24Jun'22

- Green tickz

- Jun 26, 2022

- 3 min read

NF printed neutral extreme up day with higher volume on Thursday. Buyers if defending support zones of that neutral day probe was for 15710/15740 and NF got this via gap up on Friday..Considering daily and weekly composite structure observation was that buyers need great effort to sustain further above 15750. They could not clear 15750 and ended as just balanced profile with higher value on Friday after just closing gap intra.

Context wise, buyers had edge at close on Friday with narrow range higher value day (after neutral extreme up day i.e, buyers of NE day defending) and dPOC skew at top. As discussed in closing commentary, NE day got higher follow through with dPOC skew close + daily composite of 4 days now turned into nice balance from long liquidation with dPOC skew close + weekly composite also got dPC skew close means gap up candidate next towards 15850+ probe.

And, what buyers next need is quick run towards 15950 after accepting 15850 as this 15650 to 15950 earlier was well balanced composite range..So, focus first is to move away from this week value area to 15850 then start accepting further to get 15950..Any dip from 15850 means should hold 15750-15720 zone before getting this 15950 probe.

As this 15750 composite higher end tough to get clear via intra, best option for buyers is to get clear that by gap.Failing to do so and staying below 15720 calls for easy move back to 15600/15520/15450.

Bias of 15440/15360 probe as mentioned in last report is now only if we sustain below 15720..Once we accept accept 15750 then this repair move can wait.

Larger picture :

Weekly :

NF ended the week with two week composite balance with dPOC skew..So, buyers if commited then should move away from compsite high 15750 and keep price far away for next week without coming below 15700 again..If that happens then bullish bias for the week to probe 15850/15950/16050-16100 and any pullback then that could happen from this range to retest 15800-15750..Weak below 15700 for 15600/15450/15350 as we have weak low around 15350..Quite weak below 15350 for 15200/14900. If starts accepting above 16100 then as extreme move could get 16240 and not expecting anything higher than this for the week and looking for rotation down again.If sustains 16240 with value then clean move to 16350-370/16500/16650 possible.

Monthly :

Monthly May has delivered long liquidation b profile and now June sofar double distribution profile with extn as gap between 15950-16185. Support for the month now at 15600. Staying above this could go for testing this extn gap at 15950 if accepts then would make effort to close extn till 16200 with some pause around 16050 for pullback.Once moves above 15850 support for the month can be moved to 15700 and once that goes probe back 15600/15450/15350. As of now expectation for June to defend 15600 and make attempt towards 15950/16050 then close lower defending 15700 i.e, close the month between 15700-16050..If sustains 16050 then max 16250 then close lower.

To conclude, for the coming week, staying below 15700 calls for 15600/15520/15450/15350.To avoid this,buyers need bullish open above 15750 to get 15850/15950/16050-16100 then rotate down.If sustains 16100 then 16240 and then look for rotation down.

Charts :

Daily

Weekly

Monthly

Data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments