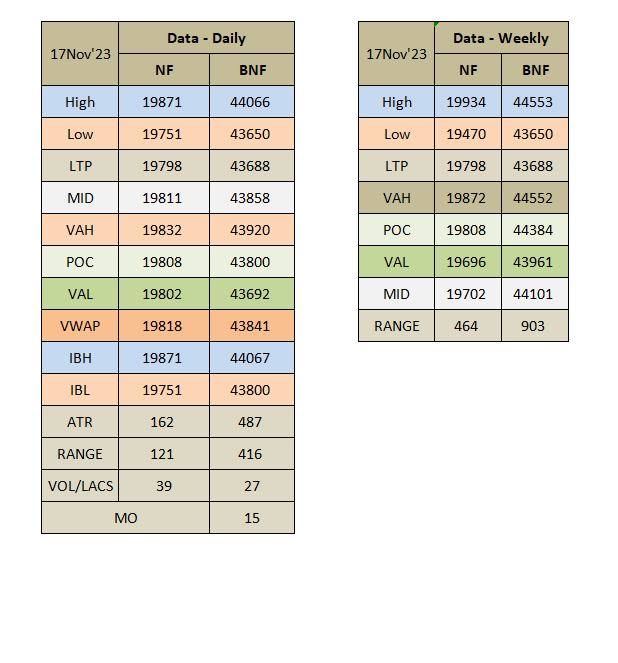

Daily market summary of NF and charts, data of NF & BNF -17Nov'23

- Green tickz

- Nov 19, 2023

- 2 min read

NF had a failed trend day with two way imbalance on expiry day. Expected auction was good balance for next session. 19775-19785 considered as lower end and 19865 HVN considered as upper end to get balance. Barring freak low open, NF managed to trade between this zone and ended up as good balanced profile to close at dVAL.

Normal day i.e, auction within IB range all day then closed at dVAL..Data wise, no demand seen and overhead excess tail controlled the auction to push for dVAL close..Imbalance early in next session else possible for another overlap session.

As long as 19910-19930 tail zone holds, swing bias is to have balance to downside auction to get 19740/19670/19590 i,e either straight down to these zones or sell on rise type of whipped auctions before getting them.

Levels wise for next session, move below 19780 could get 19750/19725-19715 if sustains below 19705 further then could get 19670/19645-19630.Failing to stay above 19860 and move below 19825 could get 19800-19790/19765-19750/19725-19715.Failing to stay below 19770 and move above 19820 could get 19850-19865 if sustains 19890-19915 possible and more bullish above it for 19945-19965.

Weekly :

NF had a balanced week closing at dPOC..Buyers needed a move above 19540 for a probe till 19860. NF paused for a day below 19540 in this week then had a large gap above 19540 which probed well above 19860 in the week gone then closed at dPOC..

Double distribution week with gap as extension and skewed upper disbn with value in upper disbn..One of rare structure to look for rally i.e, large gap extn on DD profile with value in entire upper distribution..So, as long as no acceptance above last week high, looking for balance to sideways auction to test gap zone then may be pullback or accepts well in gap zone means close of entire gap is possible in coming week.

So, staying below 19910-19930 looking for 19740/19670/19610-19590 then bounce.Acceptance below 19590 could get 19540-19520 then bounce possible. Major weakness any on weekly structure is only below 19500 which could get 19420/19330/19220. Not able to get or stay below 19740 and moving above 19930 could get 19990/20050.

Monthly :

Monthly 19480-19540 marked as solid res and goes means 19850 marked as objective. This move is done and now second disbn on monthly taking place.Kind of 19500-19670-19930 fill bias for remaining month. More bullish above 19930 for another good extn towards 20050. Mild weakness for Nov below 19500 for 19400 which is very good support for Nov now.

Charts

Daily :

Weekly :

Monthly :

Data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments