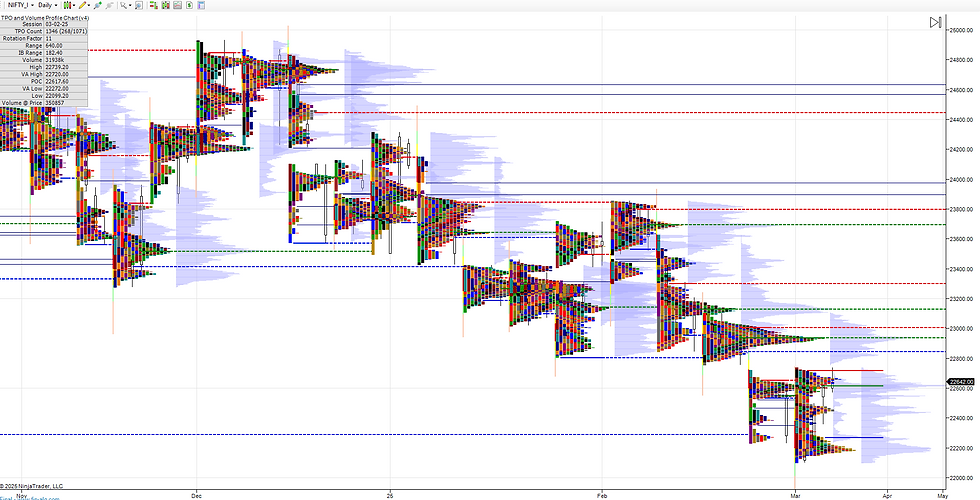

Daily market summary of NF and charts, data of NF & BNF -07Mar'25

- Green tickz

- Mar 8, 2025

- 2 min read

NF got 3rd day of short covering on expiry day.Expected balance if accepts below 22600 and if that is held means odds were there to close gap at 22660 and then for further extension towards 22730/22770.Once done expected not to accept below 22600. They had a open auction on Friday swiping around 22600 but could not hold down and gone for closing gap 22660 then tested 22730 then pulled back which held at 22600 then closed at dPOC.

3-1-3 profile with balance and tails at both ends.Sustain value = trend and rejecting beyond value area and back in value means move to other end of value and look for range extension that side.

Same 22600 ref for next session. If sustains below then trend that side and failing to stay below means back to VAH and then look for extn higher.

3rd day of one time frame up.

Odds for imbalance in next session after this 3-1-3 profile.

Check plan below for trade hypos.

Weekly :

NF closed as 3rd week of one time frame down last week. Weekly profile suggested one time frame down may stay this week also either by balance and skew down or one more push down then bounce and balance in lower disbn of weekly range. Sellers expected to defend 22370 and sustain below 22240 to get 22185/22120/22050-22010 then bounce expected.Clearing 22370 expected to get 22440/22520 reject else 22620/22690 were marked for probe.

NF held 22370 to move down first and probed till 22100 then bounced and cleared 22370 to get 22690 then closed as outside week with dPOC skew higher. 22600-22550 good support band for the buyers who pushed for outside week close. As long as this band holds, odds for the week to move higher towards 22700/22770/22840-22900 then rejection possible and not expecting beyond this for the week.If at all sustains 22900 then 23020/23150/23225/23320 possible. Below 22550 could move to 22460/22385/22280-22260 reject else 22165-22140 then 22050 odds.

Monthly :

Monthly Feb closed with spike and 22050-22450-22700 balance odds were marked to start Mar. They hit 22100 downside and bounced to 22700 end of first week of the month. If stays above 22700 then could move higher in March towards 22850 reject else 23000/23150/23300 which is solid res zone. If not able to stay above 22700 and moves below 22550 then sm balance with test of 22400/22270/22150 then decide. Staying below 22150 calls for 22050/21965/21850/21665/21450.

Charts - Daily :

Weekly :

Monthly :

Data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments