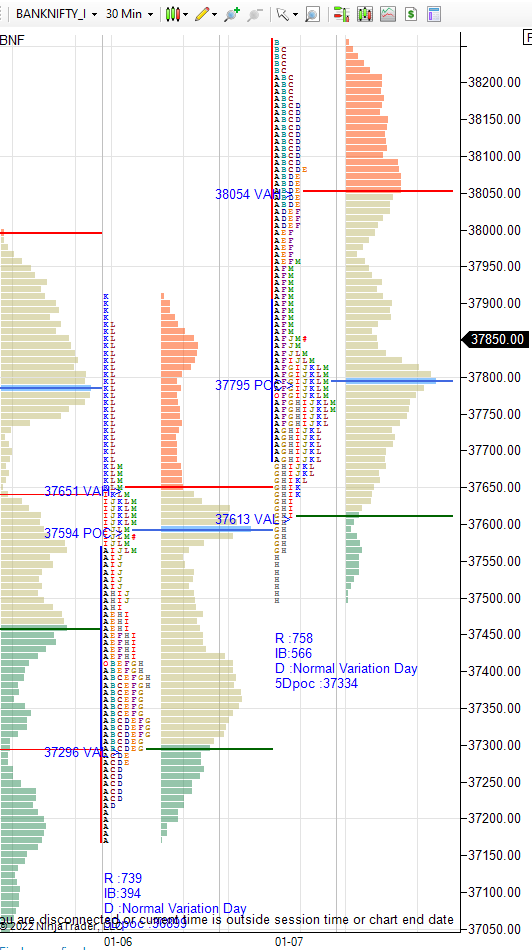

Daily market summary of NF and charts, data of NF & BNF -07Jan'22

- Green tickz

- Jan 8, 2022

- 2 min read

Observation post Thursday session :

NF stopped one time frame up of 4days and made lower low on Thursday. It was balanced session with higher volume. If buyers were committed then expected them to accept above 17920 and then should move higher to repair poor high at 17985. Failing to do so, was looking for probe back in Thursday value where it has left poor value area with anomalies.

How it auctioned on Friday :

NF got a open drive scaling above 17920 but could not sustain and gone for repairing till POC of poor value area from Thursday.

Hypos planned and played :

Move above 17820 expected to get till 17910-17920 and considered quite bullish above 17925. NF opened above 17820 gone straight to 17920 via open drive..Attempt above 17925 got whipped then it came down. Failing to stay above 17900 and back below 17820 expected to probe 17785/17755/17725-17710. NF gone for this and probed till 17735 then bounced to close at dPOC.

Auction pointers from Friday auction :

NF failed to accept in DD profile of 05/01 and left FA at top and came down to POC of 06/01. Sign of exhaustion from buyers.

It was neutral center day i.e, failing to sustain IB range at both ends and closed around dPOC.Both buyers and sellers fighting for control of auction. After DD profile on 05/01 mentioned signs of end of imbalance started from 17300 is there.And it got confirmed with lower value day next on 06/01. Now its more clear that end of imbalance and balance possible with neutral center auction now from 07/01.

Another confirmation for above said balance view is by not repairing poor value area of 06/01, NF left another poor value area now on Friday with neutral auction.So, with all these anomalies in last two days profile, we could look for some balance in coming sessions.Even if we rally higher, risk is higher with long side till we repair these profiles till 17725-17690 zone minimum.

NF got buying tail at low.If these buyers are committed then they need to defend 17840-17860 in next session and accept above 17890 for rally higher else looking for overlap session.

Hypos for next session :

17840-17860 support band.Holding this could test 17890 if accepts then 17920-17940 probe then 17965/17995/18025 possible. If accepts above 18040 then 18065/18090-18110 could be probed. If fails to stay below 17790 and accepts 17830 then could get 17870-17890 then remaining obj as mentioned above possible.

If fails to stay above 17940 and moves below 17885 then could get 17860/17835 and weak below 17825 for 17800-17790 and quite weak below 17785 for 17755/17725-17710 if sustains then 17675/17630/17600-17590 probe possible.

Charts :

Daily

Weekly

Monthly :

Data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments