Daily market summary of NF and charts, data of NF & BNF -05Jan'24

- Green tickz

- Jan 6, 2024

- 3 min read

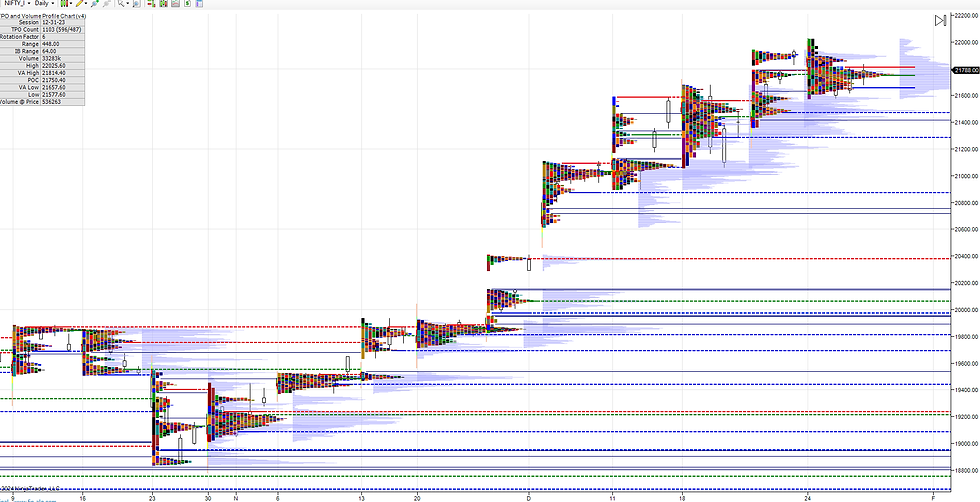

Large buying tail and squeeze day with solid buying inventory happened on expiry session. Two zones buyers next needed to defend 21770 then 21735 to get overlap to higher session failing means grind back in large buying tail expected. NF got a open higher but failed to sustain above PDH and started accepting below 21770 first then later 21735 tried to hold for long time which gave up and pushed to test large buying tail at 21685 into closing hour..Very good response they got there to push higher into close.

Overlap session into last session of P profile.2days of short covering composite now.

3-1-3 profile with tails at both ends and balance in between. Sustain value area extreme to trend else back to other end of value area and look for trending that side.

Buyers of large buying tail responded so its job of buyers for next session to defend 21720-21740 and overlap higher then push higher above PDH or better get drive from 21770 zone or get gap up and stay higher all session to move towards 21870/21920. Staying below 21720 odds of retest 21685 and that goes means slow chop down move to fill that large buying tail possible.

Swing wise advantage buyers into close and as long as holding 21720, no weakness and upside is open towards 21870/21920/21960-21970.

For next session,not accepting below 21740 and moving above 21780 could get 21810/21835 and above 21835 21870/21900-21910/21945/21970 probe. Not able to stay above 21850 and moving below 21800 could get 21770/21745/21720 if that goes test of 21685 and weakness below 21685 for 21655-21645/21615/21580/21550-21525.

Weekly :

8th week of one time frame up by end of last week. Staying below 21920 expected drop to 21785-21750/21650/21600 and that considered as good support to bounce again to 21840. For buyers needed drive/gap early in the week higher to get 21990 if accepts 22070+ expected. NF started the week with good whip move on daily profile by staying below 21920 first then bounced sharp to get 22025 and later dropped below 21920 again to move down till 21580 then bounced off to get 21835.

9th week of one time frame up and clean long liquidation profile on weekly in entire one time frame up for first time.21720 support for the week to push higher towards 21840-21870 then reject/accept there..Accepts means 21920/21970 then again look for acceptance/rejection there..If accepts short squeeze towards 22060/22120 and above possible..Not able to stay higher and dropping below 21720 could push down towards 21650-21620/21540-21525 then bounce else sm good liquidation down move possible towards 21475/21375/21325 probe.

Monthly :

Dec closed as trending profile with spike close similar to Nov. Above 21990 Jan expected to trend higher. Not doing so at start of month, expected drop and fill that last week spike zone of Dec i.e, move back to 21750/21650-21600 then bounce. NF attempted to move higher above 21990 which failed and left excess top on monthly and moved down to 21600 and now filling that spike zone of Dec..

As long as holding 21600 zone looking for more overlap to skew higher to retest 21870/21970 then decide there to negate excess and get extension higher for the month or reject and rotate back to lower end of current month range again.If 21600 sustains means downside extension could happen towards 21475/21350/21180/21050 and bullishness fully gone below 21000 for monthly time frame which could push down further towards 20850/20650 and lower.

Charts

Daily :

Weekly :

Monthly :

Data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments