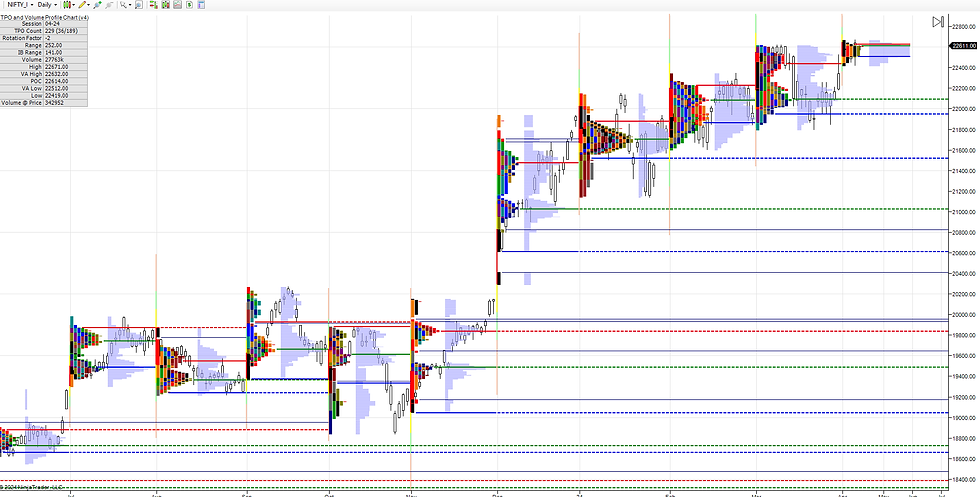

Daily market summary of NF and charts, data of NF & BNF -05Apr'24

- Green tickz

- Apr 7, 2024

- 2 min read

NF opened below VWAP of NE up day but lack of supply pushed for quite a tight range all session then closed higher with minor spike.

Low volume balanced inside day after back to back outside days.

Buyers for next session should stay above 22580 and look for drive higher to test upper end of composite in making..If sustains more bullish.

Weakness below 22580 to test 22550 zone goes means move weakness next session.

Levels wise, not able to stay below 22580 and moving above 22620 could get 22650-22660 and bullish further for 22690/22720-22740 which could reject..If sustains 22760 then 22795/22830 odds. Not able to stay above 22640 and moving below 22585 could test 22560-22550 and weakness below that for 22525/22485-22475.

Weekly :

NF closed as elongated profile last week and expectation was to look for balance roughly between 22350-22440-22570-22650. NF gone for this tight bell balance in the range of 22420-22660 for the week.Good composite balance closed above skewed dPOC for the week.Buyers should work early in the week to move away from this composite after such a close.22540-22560 solid support and holding that should move to 22660 and staying above 22660 is for 22720-22740/22830-22850.Weakness below 22540 for 22485/22440/22375/22300.

Monthly :

Apr going for 6th month of one time frame up with another ATH. 22450 pivot considered and same is holding as of now for APR.Move there resulted in good rej with FA+ tail. As long as that holds NF could trade between 22450-22660-22740-22850 for the month. 22450 goes means overlap back in Mar value area with a move back to 22350/22260 then bounce possible.

Charts and data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments