Daily market summary of NF and charts, data of NF & BNF -04Dec'24

- Green tickz

- Dec 4, 2024

- 1 min read

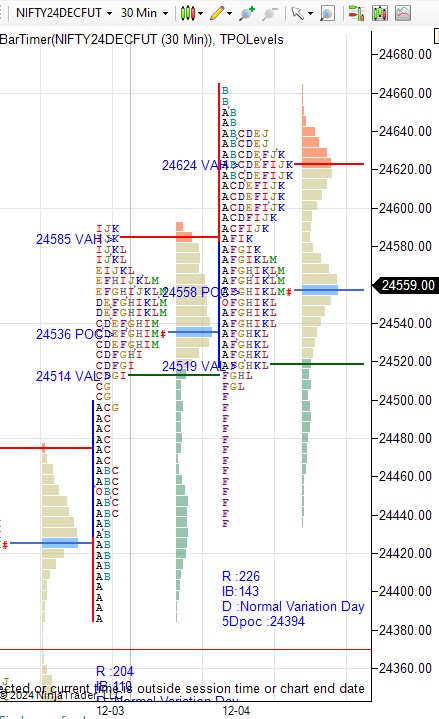

Short covering profile in last session with poor high top.Buyers had to clear poor high early in session which they did via open drive.Above 24605 marked bullish for 24630/24660/24690-24705 and they tagged 24660 by IB swipe then gone for balance. Later failed to sustain VWAP of the drive and moved back into value of P of last session which lead to liquidation in mid session to tag VAL and below. Below 24520 marked for 24465/24435 and they tagged till 24440 then bounced and after two way auction closed at dPOC.

Double distribution down day.

Large buying tail at low after clearing weak buyers.

Selling tail with ledge top pushing dPOC down and closed there = weakness..24590-24605 as long as holding for next session odds to balance and skew down to travel in lower balance and test buying tail and find buyers else PDL swipe.

Above 24605 odds to test ledge top then squeeze higher.

Odds to have inside day next finding buyers in buying tail zone and then hold below ledge top of the day..

Swing probed next obj 24630 today. Swing negation same 24420.

Levels wise for next session, if fails to stay below 24465 and moves above 24525 could get 24560/24590-24605 bullish further above 24605 for 24630/24660/24690-24705/24735. Not able stay above 24590 and move below 24550 could get 24520 weak below that for 24495/24465 if sustains 24435/24405/24365 quite weak below 24360 to get 24335-24320/24290 reject else 24260/24225/24175/24125.

Charts and data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments