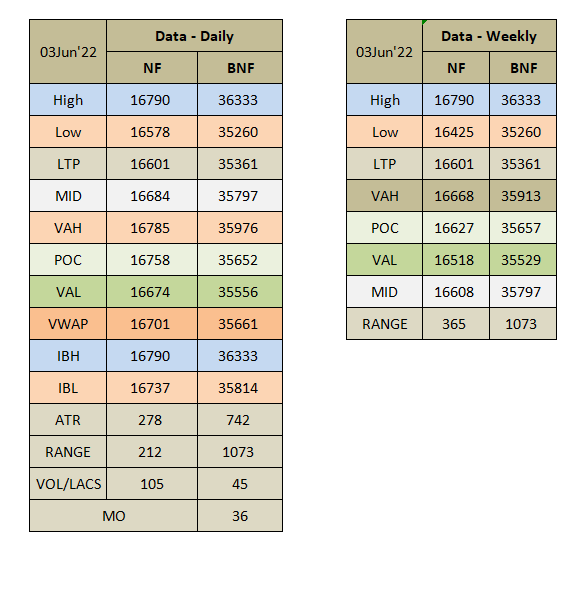

Daily market summary of NF and charts, data of NF & BNF -03Jun'22

- Green tickz

- Jun 5, 2022

- 3 min read

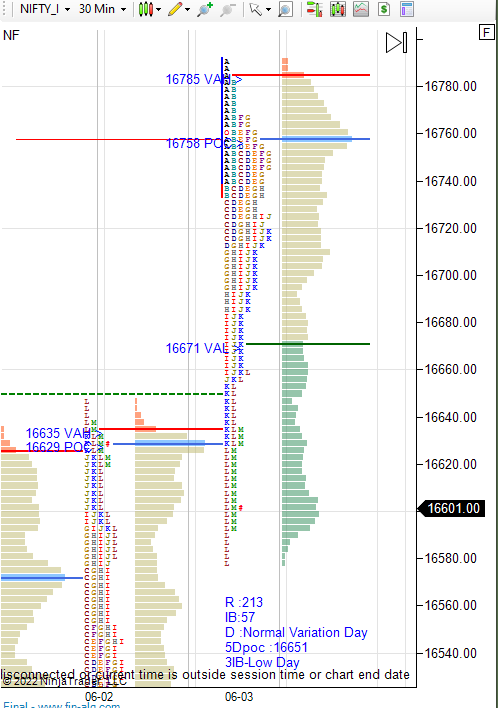

NF had a mechanically pushed failed trend day on expiry session.Had a dPOc skew into close and edge was with buyers at close..Observation was that best way to deal next by buyers with composite P, to get gap or drive. Buyers gone with large gap for open on Friday..But they could not sustain the gap after open session high and all first session got tight range which later got liquidation move to close gap, gone below POC of failed trend day of expiry session with spike down close..

Buyers from last session now stuck from upper tight balance and part of liquidation done..Failing to sustain above spike high zone, more liquidation possible to repair remaining failed trend day towards 16520/16460/16425.

It was 45 degree move away from wide dPOC..Acceptance above spike zone could get a move back to POC probe.

Spike rules apply for next session. 16630-16578 spike zone.. Accept above spike = strength ; Accept in spike/below spike = weakness.

Have mentioned that 16400-16700 range balance was the view and unless gets early follow through on Friday mentioned tough to visualise rally..They got a early follow through higher for rally but could not sustain gap hence same view of large balance in making from P composite to bell balance as of now.

Larger picture :

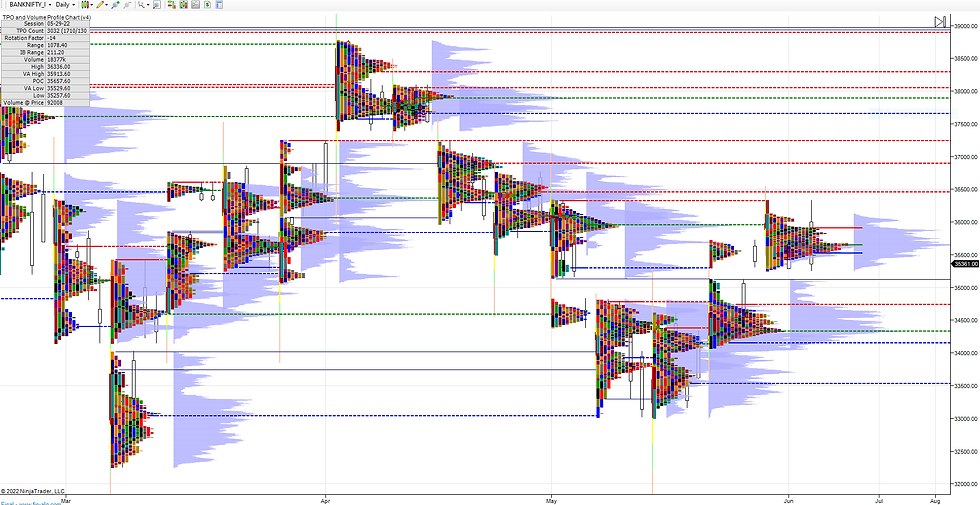

Weekly :

NF closed with 3 weeks of overlap value last week.If buyers next if committed expected them to get clean higher move above overlap early in the week i.e, should move way higher above 16420 and then sustain the move to look further higher move. NF gone for this at start of the week with large gap for the first probe zone 16590/16650. That 16650 marked as first pullback zone and it rotated down from 16690.Next if sustains 16650 probe was for 16800-16850 and that happened till 16790. Was not expecting anything above 16800-16850 mark and again expected pullback which happened at close of the week.

Now,NF printed clean higher value week above 3weeks overlap balance and closed below dPOC of current balanced week = weakness.. 16650 pivot for the week. Not able to sustain higher of this pivot could look for test of 16520 VAL of week then 16425-16400 lower end of the balanced week range.. If we hold there then could look for bounce back to 16520/16630-16670 then pullback..If sustains further then back to 16770/16850 possible then could rotate down..Sustaining 16850 with value opens up 16960/17050-17100.

If we move downside then expecting some heavy chop/whipped moves in 16350-16450 zone.Reason is, we got clean 3 weeks balane lower and clean upper balance from last week higher..So, when price tries to migrate between balance to balance may not get clean straight move but could offer sm two way heavy whips..As buyers from lower balance might fight initially on test and then sellers from upper balance also resist for sm time..So,resolving could take time before a directional move..If we sustain below 16350 then possible to get 16265/16200/16090-16050/15980/15920.

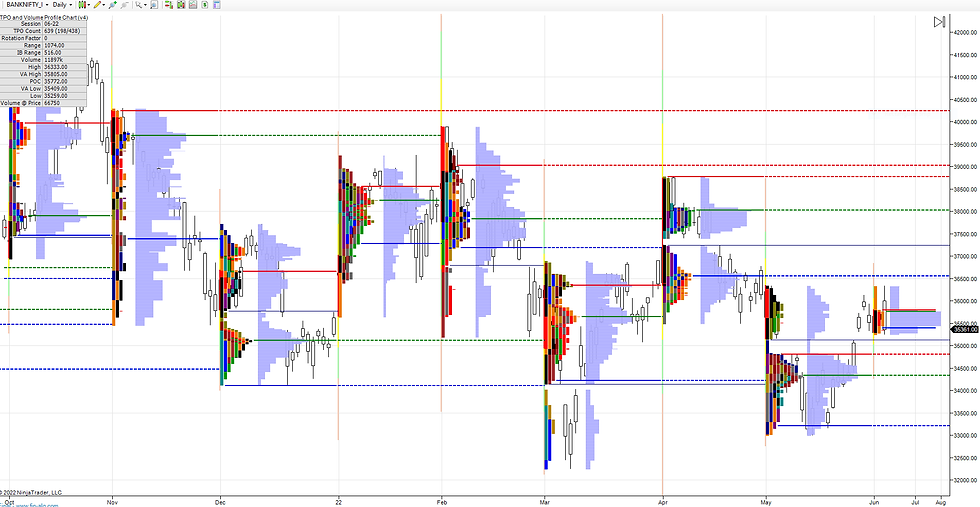

Monthly :

Monthly has closed as double distribution profile in May and now June has closed the extension gap of May and making balance to start the month..Turning into neutral view now in June to start with as DD profile extension is closed.That composite view on monthly (chart posted in last weekend report) gave a observation to look for pullback from 16800-16850 zone and its on now..This pullback if holds 16450-16350 then could look for balance to continue higher till 16850/16960/17100. Failing to get more overlap in this upper balance of first week of June and accepting below 16350 straight could drag this towards 16200-16150 then some pause and later accepts means 15920 probe possible on monthly.

To conclude, for the coming week, stay below 16650 to test 16520/16460/16400-16350 zone then look for bounce back to 16650/16770/16850 zone..If sustains then 16960/17100. Bounce from 16350 fails and accepts back below 16350 means could look for 16200/16090-16050/15980/15920.

Charts :

Daily

Weekly

Monthly

Data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments