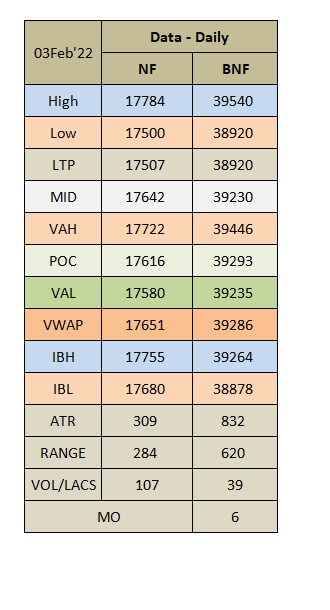

Daily market summary of NF and charts, data of NF & BNF -03Feb'22

- Green tickz

- Feb 3, 2022

- 2 min read

NF had a gap up and higher value session with minor spike into close in last session. Today marked 17750-17770 as support zone after such spike close.NF opened today right in this support band and started moving below this band which lead buyers for liquidation all session. Downside hypos were below 17750 for 17635 then 17550 below 17620. NF gone for this move fully from 17750 and then closed at low.

Auction recap :

NF confirms ST excess with that minor spike in last session.And left selling tail today.

It was 3IB down day negating event day balance fully and auction is incomplete at close.

Spike down close..Spike rules apply in next session.

Spike zone = 17580-17500.

Sustain in this zone with value = weakness for downside later in the session ;

Open and accept below this = quite weak ;

Accept above spike zone = bullish.

Swing long negation done today at 17700. This excess + tail now looking to test event day buyers at 17450 as mentioned in commentary..If they repospond around that zone, then we could look for repair of today's spike and if accepts then move higher into today imbalance zone. If no defense coming around 17450 then we have clean 200 pointer double print tail zone to get tested downside.

For tmw hypos, failing to scale above 17580 and back below 17550 could test 17520/17490 and weak below that for 17460 if sustains then 17420-17400 possible. Below 17380 could get 17350/17320/17280/17240-17220.

Failing to stay below 17460 could test 17540 if accepts then 17570/17610 possible and bullish above 17620 for 17650/17680-17690/17720-17740. If sustains 17750 then 17790/17820/17860 probe.

Charts and data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments