Daily market summary of NF and charts, data of NF & BNF -02Jul'21

- Green tickz

- Jul 3, 2021

- 4 min read

After a neutral day with spike + outside day, NF had acceptance down with lower value in last session and considered it as weakness.If fails to sustain above 15745-15765 band expected further follow through down. NF opened in this band and gone down via open drive. Probe was for 15720/15680 then 15650-15635. NF probed till 15665 in IB period and later left FA at low and turned into balaned profile from long liquidation profile and closed at highs.

Pointers from the day :

NF printed 4th day of one time frame down after that excess at 15910-15930 but unlike last 4days this time closed at higher quad.

It has printed FA at low. Though as per bookish definition not cleared IBH by close, auction wise almost reached there clean so considering FA at low.

Observation shared in last report that this move from excess of 15930 was via long liquidation auction and not due to initiative supply.So, expectation was to get one climax move to clear weak inventory further then rally back to higher levels. NF had one such open drive climax move to print new low below last 8 days range.But, could not sustain below IBL post that drive and had a nice two way auction to get clean balanced then closed at day high..This info combined with above said two pointers suggests odds are higher for swing low printed with this FA and if we stop one time frame down in next session i.e, moving above PDH then could expect that rally back move to refill entire long liquidation break of last 4days by tagging naked POC left upside then excess retest.

It was balanced auction all day with nice bell profile hence could lead to imbalance in next session.As mentioned in commentary,bias upside considering above said factors.

NF after negating 24th DD trend day, expectation was to get probe of 21st trend day probe zones..Now, this has cleared till 2nd disbn of 21st trend day..If clears FA of today could get straight to 15580 tail zone and further later in the day.

Swing sell at 15820 met its second obj 15690 today. Negation now moved to 15765. Swing buy level remains same at 15800 as mentioned yesterday with 15720 negation for 15890/15950/16020.

For next session, 15720-15700 support and bullish above 15765 for 15790/15820 and quite bullish above 15825 for 15855/15880-15905 and above 15920 could get 15950.

Weak below 15720 for 15690/15665/15635 if sustains then 15595-15580/15550-15530 probe possible.

Larger picture :

Weekly :

NF printed inside bar last week with short covering auction. If auctions above 15900 early in the week then expectation was that NF could run away higher quick towards 16020/16080 before making balance. NF started the week above 15900 but could not sustain even for hours and left tail (later confirmed as excess ) and gone down. Failing to sustain 15900 and move below 15850 expected to test 15780-15750 zone and that was kept as very good support to give a bounce. NF gone for this move till 15755 then produced one bounce to 15870 and later accepted below 15750 for the move down till 15660.

Now this is 5th week of overlap profile and got excess too at top. As mentioned earlier many times, too much of overlap = weakness/reversal ; 3-5 periods of overlap is fine and can consider them as consolidation in the ongoing trend. But if stretcthes the overlap beyond 5 weeks then its end of auction with exhaustion and could see reversal. So, NF should avoid further overlap and should start accepting above 15910 excess zone to move away from this overlap to get fresh leg up.

As of now based on daily structure, expectation for the week is to hold 15700 to get 15855/15910 excess retest then above 15950 move towards 16020/16080-16120. Once moves above 15910 then negation for this view moves to 15800. Failing to sustain above 15950 could drop back to 15850-15800 and should see a bounce. If accepts below 15800 then retest of 15720/15650 and quite weak below 15650 for 15580/15520-15500. Below 15500 bull run is over for some time.

Monthly :

Month was expected to end as nice balanced profile since first week of month and it ended so.June month has created clean balanced profile and imbalance next is the expectation and bias is, we can consider June as pause in long run and could produce imbalance upside i.e to move higher to 15900/16100 from here considering daily and weekly structure.Support was marked as 15500 and now can shift this to 15600 below VAL of month.

If this fails to get imbalance higher to clear 15900 and breaks 15600 then imbalance down could start on monthly from this balanced profile for minimum of 5% correction. If sustains above 15900 for a day or few sessions then fails to sustain means then balance rules in place to get a move back to 15750/15600/15500 below 15900 acceptance.

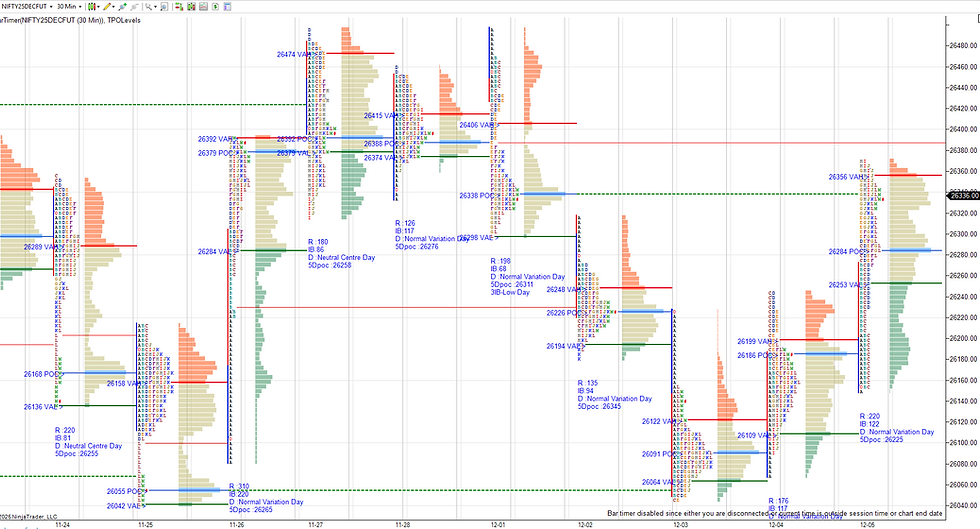

Charts :

Daily

Weekly

Monthly

Data :

Detailed plan with references to carry forward, trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members via private blog.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments