Daily market summary for NF and charts, data for NF & BNF -20Nov’20

- Green tickz

- Nov 22, 2020

- 2 min read

NF registered a outside day on Thursday as well as neutral day with FA at top. Expectation was to get follow through down in next session after that FA at top with volume. After having OAIR in prev imbalance zone 12770-12860 in first hour, NF gone for extension down below PDL.But, it could not sustain well below PDL and met with exhaustion. It could not get 12720 probe below 12770..Failing to sustain below 12770 was expected back to 12860 and then 12910 and NF gone for this auction in second session and closed above dVAH.

NF printed another neutral day..Important now to hold 12820 and clear 12900 at top for buyers to take control further, who closed at dVAH.

Explained about two distinct balance we are having now with NF in last report.Hence it was important for sellers to sustain below 12770 else two way volatile auction was expected..NF has gone for this move..We could now get more of such move if we fail to hold 12770 again. As explained in previous post, then we could have large range to make this two balance as one large composite.

Though NF had a close above dVAH, considering the move weak as value was lower which accepted prev day imbalance. And, the extn happened above 12850 got closed intra itself suggesting lack of demand in that upper distribution in the last hour balance.12820-12800 is magnet for next session as mentioned in commentary. To negate this view, NF needs to scale 12900 early in the next session.

For next session, failing to scale 12900 could test 12820-12800 and weak below 12800 for 12770/12720/12670 and quite weak below 12670 for 12620/12590.

Holding 12800-12820 could test 12865 if sustains then 12900/12930/12965 probe possible and quite bullish above 12970 for 13010/13050/13090..

Failing to sustain below 12765 and move above 12820 could get 12850/12900.

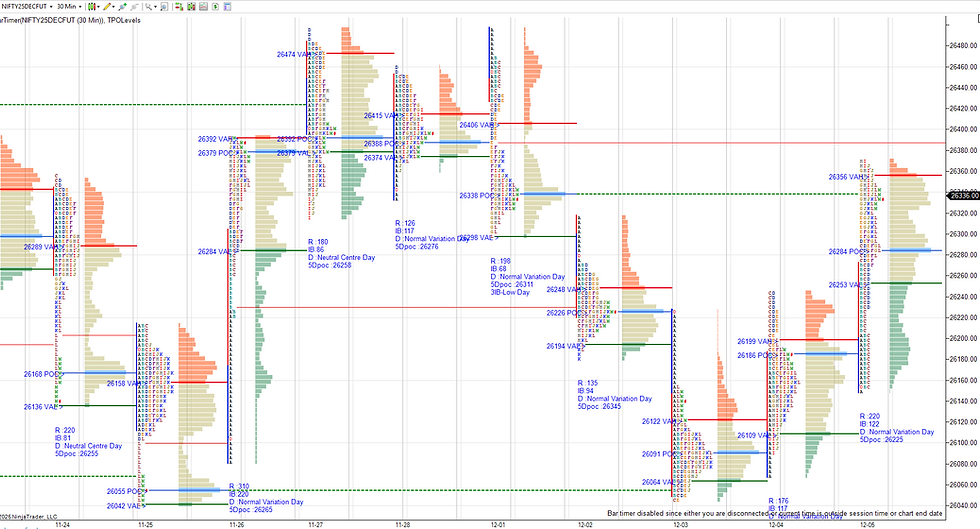

Charts :

Daily

Weekly

Monthly

Data

Detailed plan with refs to carry forward, trade hypos and nuances from the day and view based on larger weekly and monthly structure are available to members.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments