Daily market summary for NF and charts,data for NF & BNF -06Oct’20

- Green tickz

- Oct 6, 2020

- 2 min read

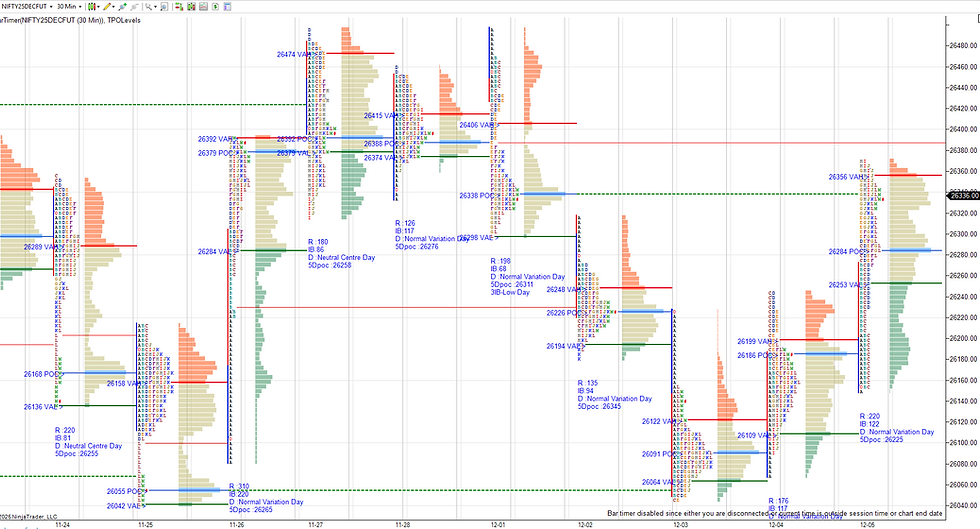

With 3-1-3 profile and close at dPOC, observation was that buyers were in control and they had to get further follow through in next session to look for a probe of 11620. NF probed around 11610 by IB time then gone for quite a tight open auction balance of just 40 points for all day till last hour..Then, had a good spike with volume imbalance and closed around spike high.

Buyers got another higher value day and 7th day of 1time frame up..Still going stronger and no sign of weakness.

This spike which happened with good volume is ref for next session.Spike rules to apply.

Spike zone – 11613-11684

Acceptance above spike high = quite bullish

Value in spike zone = bullish for move higher later

Acceptance below spike low = weakness

It was 3IB move as well as 45 degree move away from POC of wide balance by price..With all this 3IB+spike+45 degree factors, its buyers job to create value higher staying away from 11610 all day to look for move higher further..Failing to do so could see a reversal below 11610..

NF almost accepted half of previous extn singles between 11620-11780 and holding higher value, probe is for 11780 naked POC zone next then new swing high towards 11820. The zone between 11820-11880 is previous strong supply zone and unlikely to have straight acceptance there with underlying daily profile structure..Could look for pullback before entering into this zone..

Price wise, holding above 11610 probe is for 11720-11750/11780-11820.

Failing to sustain above 11720 could call for balance between 11640-11720 before next move..

Weak below 11610 for 11570-11550/11510/11450.

Chart and data :

Detailed plan with refs to carry forward, trade hypos and nuances from the day available to members.

Comments