Daily market summary of NF and charts, data of NF & BNF -20Jan'22

- Green tickz

- Jan 20, 2022

- 2 min read

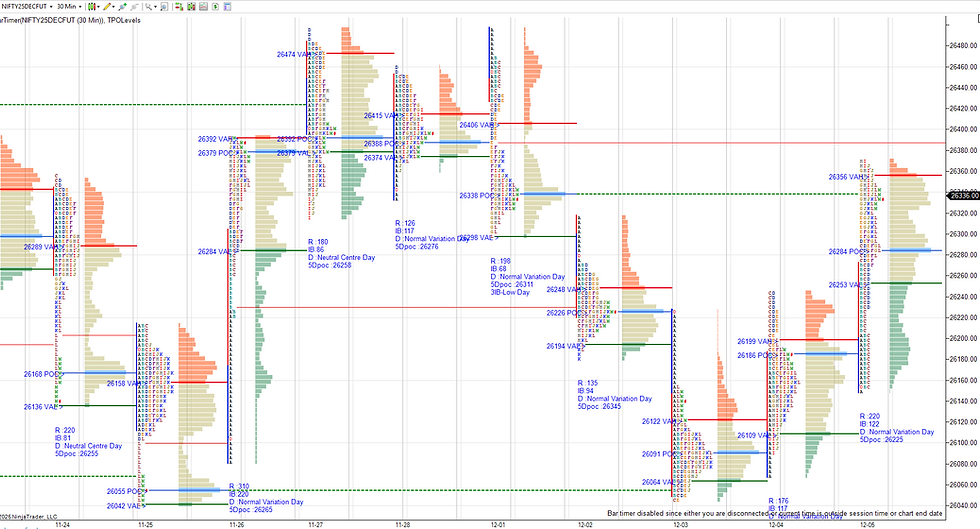

After confirming ST excess tail at top on 18/01, NF gone for clean lower value day in last session.Observation was that no sign of demand and more liquidation to follow considering incomplete auction with quite weak/poor low at 17905 last week low. NF gone for more liquidation today with close to 3IB move. Open if drives below 17905 then probe was for 17835 which happenened in first session with a move till 17805 and later completed downside obj marked till 17710 then bounced at close for dPOC.

Auction pointers from the day :

NF printed second day of large liquidation. That ST excess marked at 18350 zone done the job quick.

Mentioned in 18/01 report as well as in yday report that closing the gap 18100 and move below likely to repair that poor structured move started from 17710 quick. This got completed today and got secured low via tail at low today which closed at dPOC..Now, as long as 17720-17680 zone holds could look for balance in last two days long liquidation profiles range.

If today tails holds and pushes price higher to repair last two days long liquidation profiles, it may look like a rally/fresh upmove. But mostly could be sold off to make a balance, as its quite tough to reverse such two large liquidation profiles of last two sessions and move away higher further.So, 17950 zone or 18100-18200 zone upside max to look for rotation down for coming sessions.

Once balance is done, move below 17680 again means we could look for 17520/17410 from where Jan trending move started..

Kindly refer hypos in the plan below for trades.

Charts and data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments